POWERFUL IDEAS - SMALL FINANCE BANKS

[SOMETHING SEEMS TO BE BREWING IN SMALL FINANCE BANKS IN INDIA]

Covering a technical view on the following stocks:

#EQUITASBNK [EQUITAS SMALL FINANCE BANK]

#SURYODAY [SURYODAY SMALL FINANCE BANK]

#UJJIVANSFB [UJJIVAN SMALL FINANCE BANK]

#AUBANK [AU SMALL FINANCE BANK]

Let’s dive in!

#EQUITASBNK [EQUITAS SMALL FINANCE BANK]

The stock had formed a nice Cup & Handle and had broken out of in the last week.

The volume build-up has been great and has the footprint of institutional activity.

It has been showing very good relative strength.

Stock seems to be in a Stage 2 Advancing phase with all the Mas stacked up well in order, rising and with price above the MAs.

Also enjoying sector tailwinds - Banking has been doing well

Stock is near ATH

#SURYODAY [SURYODAY SMALL FINANCE BANK]

Stock has broken out of a medium-term sloping trendline

The volume build-up has been great and has the footprint of institutional activity

Has been showing very good Relative strength

Stock seems to be in the process of breaking into a Stage 2 Advancing phase. The MAs are just getting aligned

Also enjoying sector tailwinds - Banking has been doing well

Stock has a lot of overhead supply which it needs to clear

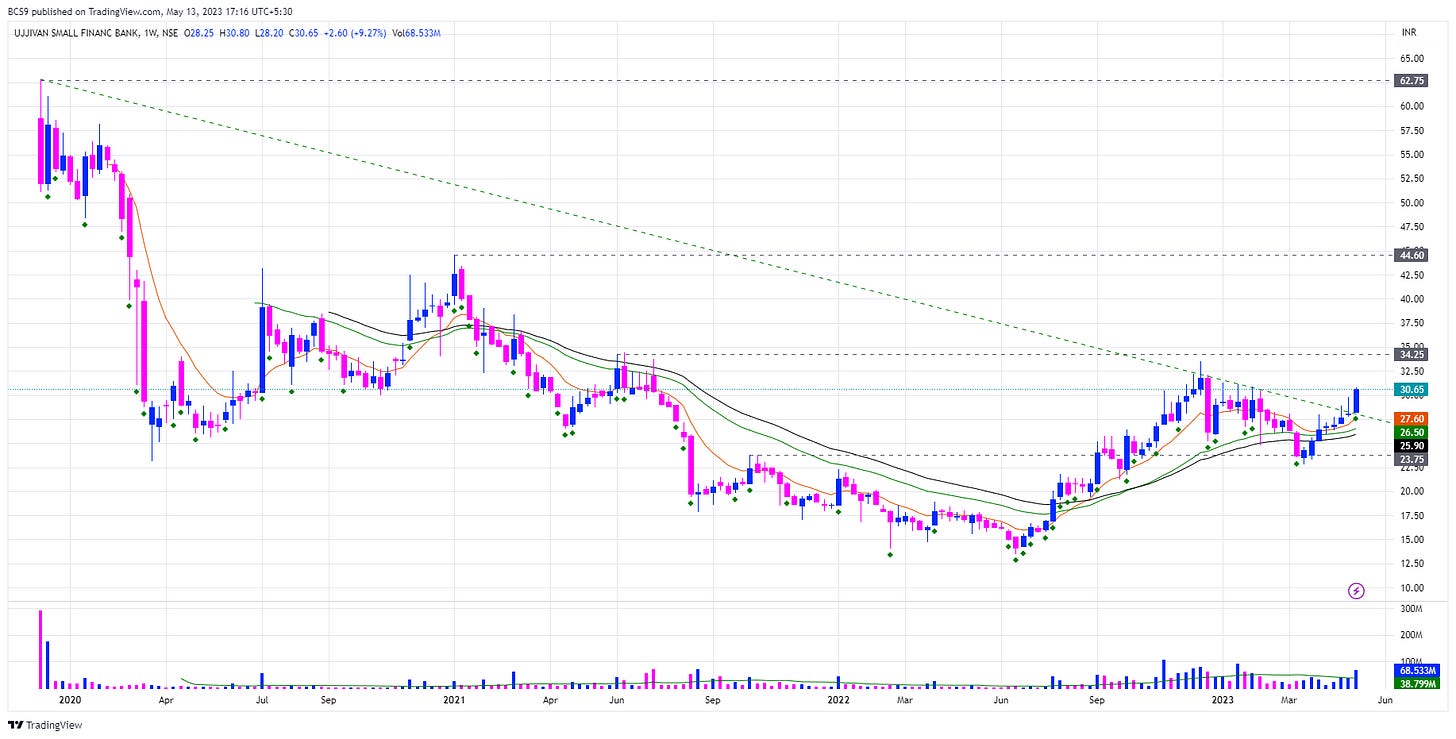

#UJJIVANSFB [UJJIVAN SMALL FINANCE BANK]

Stock has broken out of a long-term sloping trendline

The volume build-up has been great and has the footprint of institutional activity

Has been showing moderate Relative strength

Stock seems to be in a Stage 2 Advancing phase with all the MAs stacked up well in order, rising and with price above the MAs.

Also enjoying sector tailwinds - Banking has been doing well

Stock has a lot of overhead supply which it needs to clear

#AUBANK [AU SMALL FINANCE BANK]

Stock has been consolidating in a big parallel channel since March 2021

The volume build-up has been just started and has the footprint of institutional activity

Has been showing good Relative strength

MAs are just stacking up but the stock still seems to be in a consolidation mode

Also enjoying sector tailwinds - Banking has been doing well

SUMMARY

3 out of 4 stocks have a lot of common characteristics, especially the charts setting up, build-up of volume, institutional activity and relative strength.

Such coincidences don’t happen just like that.

Institutional activity usually happens in tandem within a sector or sub-sector. And, it always pays to go with the institutions.

Looks like these Small Finance Banks have just started attracting a lot of attention and a good case for a solid upside is just building up.

The above is just for educational purposes. This is not an investment advice or recommendation to trade in these stocks.

#Stocks #Stockstowatch #Banking #Markets