SECTORAL INDICES ROTATION WATCH

WHICH SECTORS ARE LEADING AND WHICH ONES ARE LAGGING; WHICH ARE HOT AND WHICH ARE NOT! [FOR JUNE 2023]

OVERVIEW

Passive investing is a style which has a huge fan following across the world. The basic premise is that you don’t need to always be active in the market, and can generate good returns even if you invest passively. One of the things that works extremely well is the low-cost aspect in passive investing. Needless to say, this works best if one employs Exchange Traded Funds (ETFs).

However, I have found that there are two basic issues with this recommended style:

It advocates people to keep buying and averaging out. I am against the basic concept of averaging down on any asset (why put more money in a losing asset!).

It also advocates for holding an ETF for years together. Again, if its on a downtrend, what is the point of holding it for years.

I have re-worked the above approach on Passive Investing and have added my own modifications to it, and have tried-and-tested this on one of my own accounts. Here, I track the different sectors and keep a watch for which ones are on an uptrend and which ones are on a downtrend. And, I try to take advantage of this information by using sector rotation and positioning myself with the winning ones. The winning ones are usually the ones which also have an institutional footprint.

A good and strong sector is a wonderful tailwind to have!

ANALYSIS

Let’s look at the how the various sectoral indices are doing and then we can derive which ones are doing well and which ones are not. This will allow us to look at the respective ETFs for the coming month.

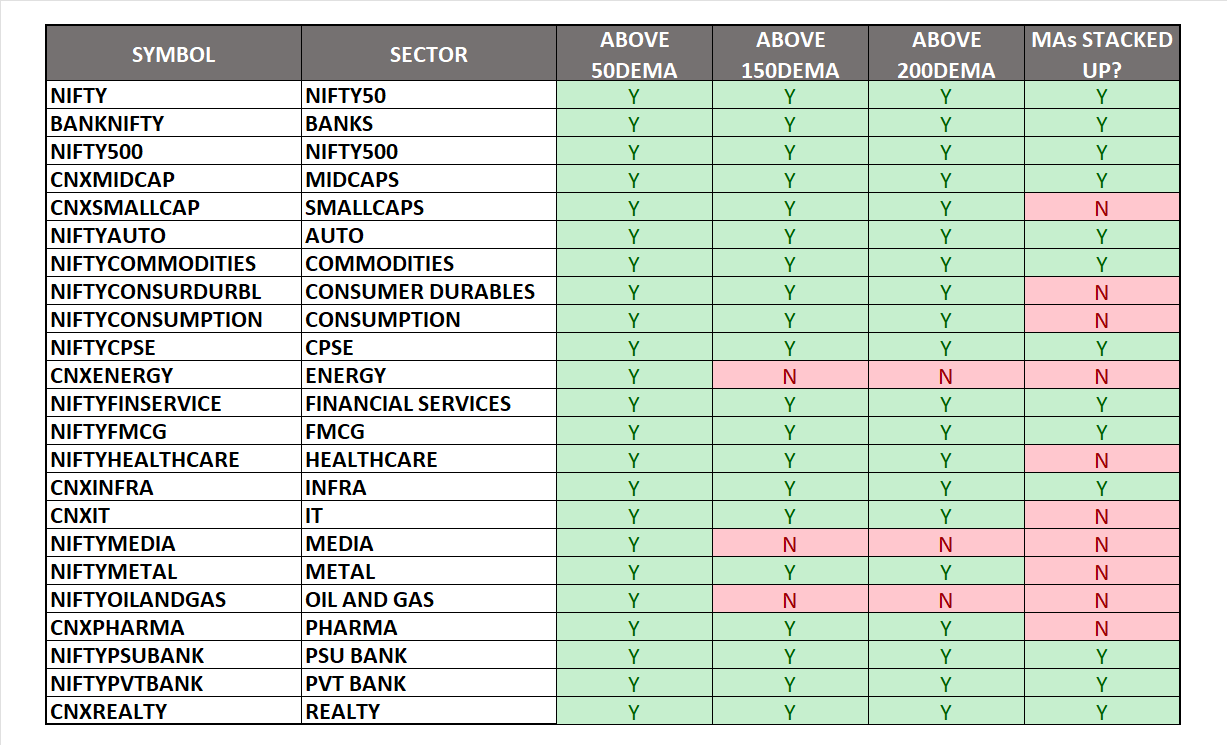

I prefer to rank the sectors into 3 categories as follows:

A: Good for deployment

B: Under watch

C: Avoid

Let’s dive in!

1. NIFTY

TREND GUIDE:

Breakout above Consolidation Base: NO

Good Buying Momentum: YES

Stage 2 Advancing Phase: YES

No / Minimal Overhead Supply: YES

Market Structure: HH-HL

COMMENTARY:

In an uptrend. At the cusp of a base breakout.

FINAL RANKING: B

2. BANKNIFTY

TREND GUIDE:

Breakout above Consolidation Base: NO

Good Buying Momentum: YES

Stage 2 Advancing Phase: YES

No / Minimal Overhead Supply: YES

Market Structure: HH-HL

COMMENTARY:

Uptrend. At the cusp of a base breakout.

FINAL RANKING: B

3. NIFTY500

TREND GUIDE:

Breakout above Consolidation Base: NO

Good Buying Momentum: YES

Stage 2 Advancing Phase: YES

No / Minimal Overhead Supply: YES

Market Structure: HH-HL

COMMENTARY:

Uptrend. trying to reach top of base.

FINAL RANKING: B

4. NIFTY MIDCAPS

TREND GUIDE:

Breakout above Consolidation Base: YES

Good Buying Momentum: YES

Stage 2 Advancing Phase: YES

No / Minimal Overhead Supply: YES

Market Structure: HH-HL

COMMENTARY:

Strong Uptrend. ATH.

FINAL RANKING: A

5. NIFTY SMALLCAPS

TREND GUIDE:

Breakout above Consolidation Base: YES

Good Buying Momentum: YES

Stage 2 Advancing Phase: YES

No / Minimal Overhead Supply: NO

Market Structure: TRYING TO FORM NEW STRUCTURE

COMMENTARY:

Uptrend trying to get established.

FINAL RANKING: A

6. NIFTY AUTO

TREND GUIDE:

Breakout above Consolidation Base: YES

Good Buying Momentum: YES

Stage 2 Advancing Phase: YES

No / Minimal Overhead Supply: YES

Market Structure: HH-HL

COMMENTARY:

Strong Uptrend. RSI getting into Over-bought zone.

FINAL RANKING: A

7. NIFTY COMMODITIES

TREND GUIDE:

Breakout above Consolidation Base: NO

Good Buying Momentum: NO

Stage 2 Advancing Phase: NO

No / Minimal Overhead Supply: NO

Market Structure: NA

COMMENTARY:

Still in consolidation phase.

FINAL RANKING: C

8. NIFTY CONSUMER DURABLES

TREND GUIDE:

Breakout above Consolidation Base: NO

Good Buying Momentum: JUST STARTING

Stage 2 Advancing Phase: NO

No / Minimal Overhead Supply: NO

Market Structure: TRYING TO FORM

COMMENTARY:

Trying to form new structure. At the cusp of a breakout

FINAL RANKING: B

9. NIFTY CONSUMPTION

TREND GUIDE:

Breakout above Consolidation Base: NO

Good Buying Momentum: YES

Stage 2 Advancing Phase: YES

No / Minimal Overhead Supply: YES

Market Structure: HH-HL

COMMENTARY:

Uptrend. Trying to reach top of base. RSI just entering overbought zone.

FINAL RANKING: A

10. NIFTY CPSE

TREND GUIDE:

Breakout above Consolidation Base: YES

Good Buying Momentum: YES

Stage 2 Advancing Phase: YES

No / Minimal Overhead Supply: YES

Market Structure: HH-HL

COMMENTARY:

Uptrend. Near ATH. Taking support at the 10 Weekly.

FINAL RANKING: A

11. NIFTY ENERGY

TREND GUIDE:

Breakout above Consolidation Base: NO

Good Buying Momentum: NO

Stage 2 Advancing Phase: NO

No / Minimal Overhead Supply: NO

Market Structure: YET TO FORM

COMMENTARY:

Consolidation stage.

FINAL RANKING: C

12. NIFTY FINANCIAL SERVICES

TREND GUIDE:

Breakout above Consolidation Base: NO

Good Buying Momentum: YES

Stage 2 Advancing Phase: YES

No / Minimal Overhead Supply: YES

Market Structure: HH-HL

COMMENTARY:

At the cusp of breaking out. Also near ATH.

FINAL RANKING: A

13. NIFTY FMCG

TREND GUIDE:

Breakout above Consolidation Base: YES

Good Buying Momentum: YES

Stage 2 Advancing Phase: YES

No / Minimal Overhead Supply: YES

Market Structure: HH-HL

COMMENTARY:

At ATH. Strong Stage 2. RSI in overbought region, could be over-heated.

FINAL RANKING: B

14. NIFTY HEALTHCARE

TREND GUIDE:

Breakout above Consolidation Base: YES

Good Buying Momentum: YES

Stage 2 Advancing Phase: NO

No / Minimal Overhead Supply: NO

Market Structure: YET TO FORM

COMMENTARY:

Breakout from since-inception trendline. In the process of forming new structure. Registering some strong upside momentum.

FINAL RANKING: B

15. NIFTY INFRA

TREND GUIDE:

Breakout above Consolidation Base: NO

Good Buying Momentum: PARTLY

Stage 2 Advancing Phase: YES

No / Minimal Overhead Supply: YES

Market Structure: HH-HL

COMMENTARY:

At the cusp of base breakout.

FINAL RANKING: B

16. NIFTY IT

TREND GUIDE:

Breakout above Consolidation Base: NO

Good Buying Momentum: YES

Stage 2 Advancing Phase: NO

No / Minimal Overhead Supply: NO

Market Structure: YET TO FORM

COMMENTARY:

Trying to recover from recent fall.

FINAL RANKING: C

17. NIFTY MEDIA

TREND GUIDE:

Breakout above Consolidation Base: NO

Good Buying Momentum: NO

Stage 2 Advancing Phase: NO

No / Minimal Overhead Supply: NO

Market Structure: LH-LL

COMMENTARY:

Trying to find a bottom and change structure.

FINAL RANKING: C

18. NIFTY METAL

TREND GUIDE:

Breakout above Consolidation Base: NO

Good Buying Momentum: NO

Stage 2 Advancing Phase: NO

No / Minimal Overhead Supply: NO

Market Structure: YET TO FORM

COMMENTARY:

Still consolidating. Has taken support at a major trendline and is in the process of forming a new structure.

FINAL RANKING: C

19. NIFTY OIL AND GAS

TREND GUIDE:

Breakout above Consolidation Base: NO

Good Buying Momentum: NO

Stage 2 Advancing Phase: NO

No / Minimal Overhead Supply: NO

Market Structure: NONE

COMMENTARY:

Seems to be in a confused state.

FINAL RANKING: C

20. NIFTY PHARMA

TREND GUIDE:

Breakout above Consolidation Base: YES

Good Buying Momentum: YES

Stage 2 Advancing Phase: NO

No / Minimal Overhead Supply: NO

Market Structure: YET TO FORM

COMMENTARY:

Breakout from trendline. Registering strong moves.

FINAL RANKING: B

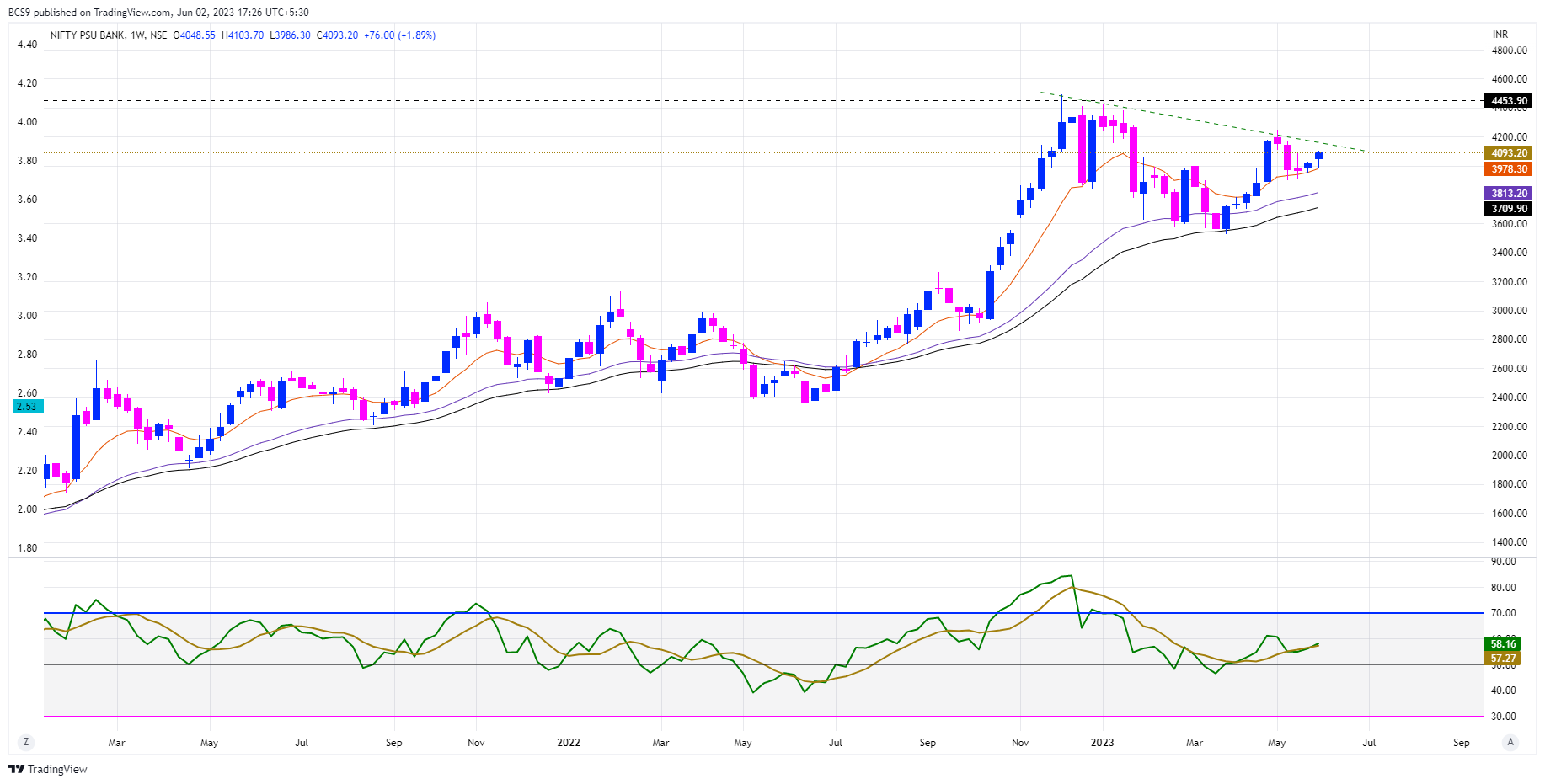

21. NIFTY PSU BANKS

TREND GUIDE:

Breakout above Consolidation Base: NO

Good Buying Momentum: NO

Stage 2 Advancing Phase: YES

No / Minimal Overhead Supply: NO

Market Structure: YET TO FORM

COMMENTARY:

Trying to approach trendline for breakout. Also in the process of forming new structure. Resting on the 10 Weekly. Seems ready for good moves.

FINAL RANKING: A

22. NIFTY PRIVATE BANKS

TREND GUIDE:

Breakout above Consolidation Base: NO

Good Buying Momentum: YES

Stage 2 Advancing Phase: YES

No / Minimal Overhead Supply: YES

Market Structure: HH-HL

COMMENTARY:

Approaching top of base.

FINAL RANKING: B

23. NIFTY REALTY

TREND GUIDE:

Breakout above Consolidation Base: YES

Good Buying Momentum: ES

Stage 2 Advancing Phase: NO

No / Minimal Overhead Supply: NO

Market Structure: HH-HL

COMMENTARY:

Strong momentum. RSI approaching overbought zone.

FINAL RANKING: A

SUMMARY

A: Good for deployment

MIDCAPS, SMALLCAPS, AUTO, CONSUMPTION, CPSE, FINANCIAL SERVICES, PSU BANKS, REALTY

B: Under watch

NIFTY, NIFTYBANK, NIFTY500, CONSUMER DURABLES, FMCG, HEALTHCARE, INFRA, PHARMA, PRIVATE BANKS,

C: Avoid

COMMODITIES, ENERGY, IT, MEDIA, METAL, OIL & GAS,

Now, all I need to do is to just focus on the sectors looking good and the ETFs representing those sectors.

This study also helps me to keep the best sectors at the top of my mind so that, when I am selecting individual stocks, I can select them from the best sectors only.

Simple, isn’t it?

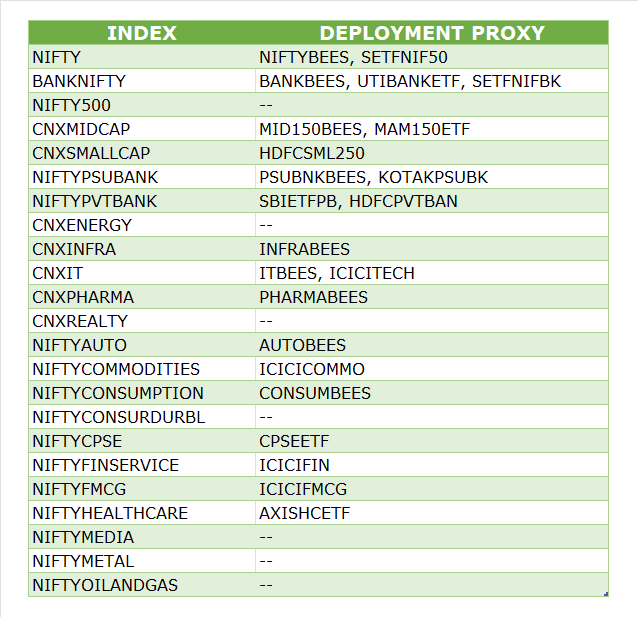

ANNEXURE

The following are the deployment proxies (ETF only) for the various sectors’ sub-indices:

NB: Only the ones with highest liquidity taken in this list. Some of the indices don’t have an ETF yet.

DISCLAIMER:

All information provided here is for educational purposes only and does not constitute any investment advice or recommendation. Please do your own due diligence. Products mentioned are just representative in nature and not recommendations. There is no financial incentive to write about any particular Stock / AMC / ETF. All data taken is the latest to the best of my knowledge.