INTRODUCTION

In my daily scan & study of stocks, a lot of Hotel Stocks have been popping up. This is the time to do a detailed technical review of these.

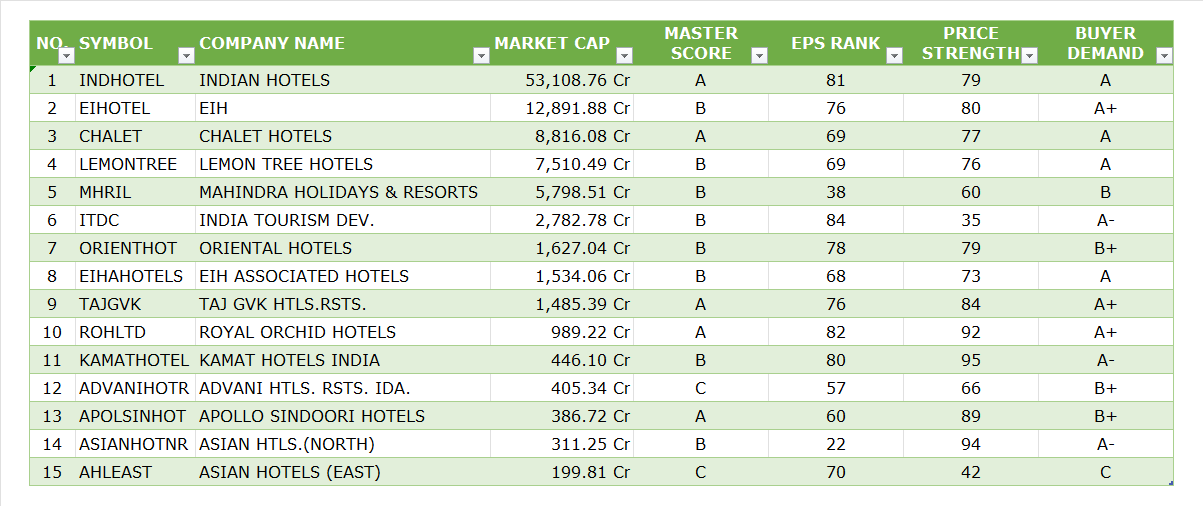

The following table gives a complete categorization of the top Hotel Stocks in India. Only those with a Market Cap of ~200 Crores Rupees and above have been included in the study.

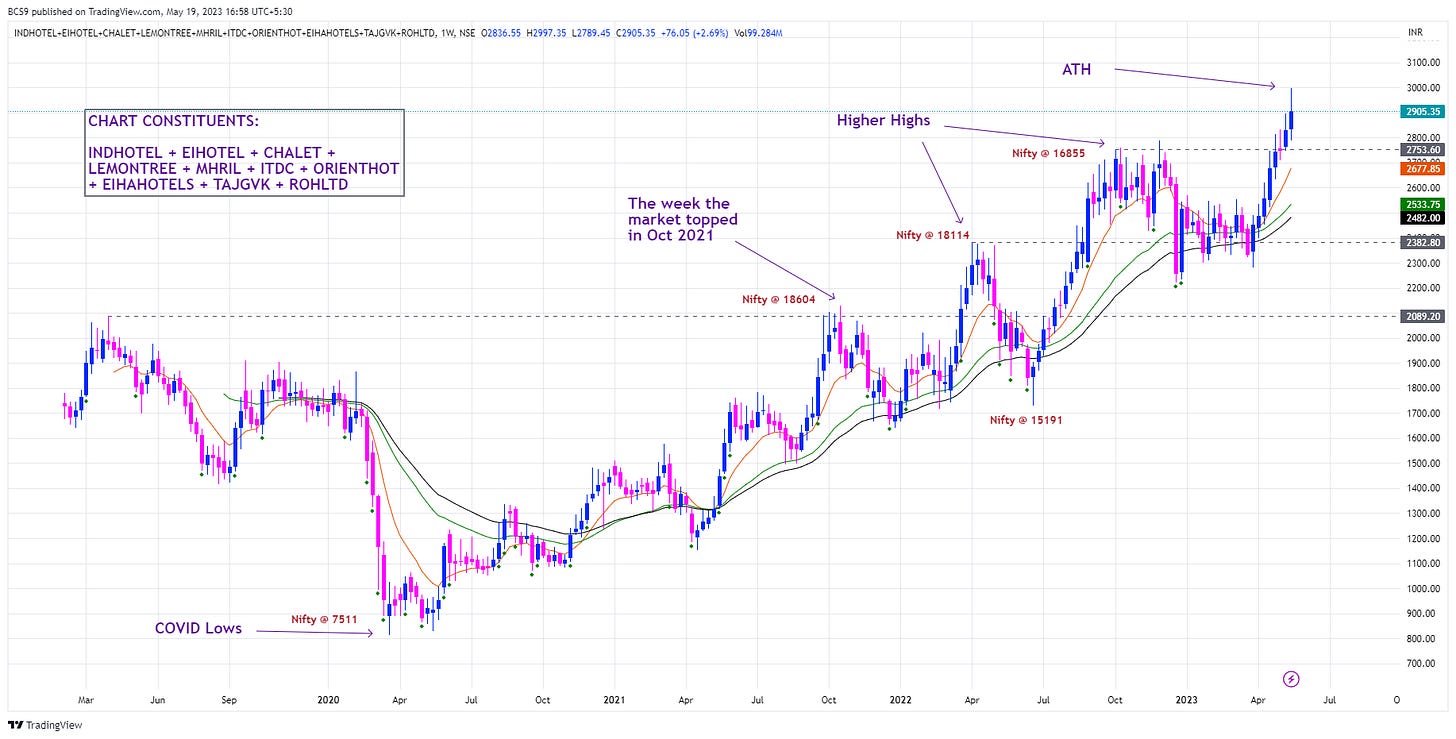

The following covers a technical view of the top stocks in this industry. Have taken the top 10 stocks together, which covers 98% of the entire industry’s Market Cap.

Observations from the above:

The hotel industry has been on an up-swing ever since the threat of COVID started receding.

This has been showing a very good Relative Strength vis-a-vis Nifty. While Nifty was heading down, this was making Higher Highs.

Right now, the industry is at an ATH (from a combined price perspective)

Considering the above, the industry looks very strongly poised and one can look at stronger stocks within this industry.

I want to take a detailed look at the addressable stocks given above to see which ones are looking good. I use what I call as The MoneyMan Trend Guide which combines a lot of parameters to enable me to make very good judgments on which stocks are ripe for the picking!

Let’s dive in!

STOCKS ANALYSIS

1. INDIAN HOTELS [#INDHOTEL]

Market Cap: Rs. 53,109 Cr.

TREND GUIDE:

Breakout above Consolidation Base: YES

Good Buying Momentum : YES

Good Volume Build-up: YES

Stage 2 Advancing Phase: YES

Institutional Footprint: YES

Strong Sector: YES

Good Relative Strength: YES

No / Minimal Overhead Supply: YES

FINAL JUDGMENT: LOOKING VERY GOOD

EIH LTD. [#EIHOTEL]

Market Cap: Rs. 12,892 Cr.

TREND GUIDE:

Breakout above Consolidation Base: YES

Good Buying Momentum : YES

Good Volume Build-up: YES

Stage 2 Advancing Phase: YES

Institutional Footprint: YES

Strong Sector: YES

Good Relative Strength: YES

No / Minimal Overhead Supply: YES

FINAL JUDGMENT: LOOKING GOOD

CHALET HOTELS [#CHALET]

Market Cap: Rs. 8,816 Cr.

TREND GUIDE:

Breakout above Consolidation Base: YES

Good Buying Momentum : YES

Good Volume Build-up: YES

Stage 2 Advancing Phase: YES

Institutional Footprint: YES

Strong Sector: YES

Good Relative Strength: YES

No / Minimal Overhead Supply: YES

FINAL JUDGMENT: LOOKING VERY GOOD

LEMON TREE HOTELS [#LEMONTREE]

Market Cap: Rs. 7,510 Cr.

TREND GUIDE:

Breakout above Consolidation Base: YES

Good Buying Momentum : YES

Good Volume Build-up: YES

Stage 2 Advancing Phase: YES

Institutional Footprint: YES

Strong Sector: YES

Good Relative Strength: YES

No / Minimal Overhead Supply: YES

FINAL JUDGMENT: LOOKING GOOD

MAHINDRA HOLIDAYS & RESORTS [#MHRIL]

Market Cap: Rs. 5,798 Cr.

TREND GUIDE:

Breakout above Consolidation Base: NO

Good Buying Momentum : YES

Good Volume Build-up: YES

Stage 2 Advancing Phase: YES

Institutional Footprint: YES

Strong Sector: YES

Good Relative Strength: YES

No / Minimal Overhead Supply: YES

FINAL JUDGMENT: LOOKING GOOD

INDIAN TOURISM DEVELOPMENT CORPORATION [#ITDC]

Market Cap: Rs. 2,783 Cr.

TREND GUIDE:

Breakout above Consolidation Base: NO

Good Buying Momentum : NO

Good Volume Build-up: NO

Stage 2 Advancing Phase: NO

Institutional Footprint: NO

Strong Sector: YES

Good Relative Strength: NO

No / Minimal Overhead Supply: NO

FINAL JUDGMENT: NOT LOOKING GOOD

ORIENTAL HOTELS [#ORIENTHOT]

Market Cap: Rs. 1,627 Cr.

TREND GUIDE:

Breakout above Consolidation Base: YES

Good Buying Momentum : YES

Good Volume Build-up: YES

Stage 2 Advancing Phase: YES

Institutional Footprint: YES

Strong Sector: YES

Good Relative Strength: YES

No / Minimal Overhead Supply: YES

FINAL JUDGMENT: LOOKING VERY GOOD

EIH ASSOCIATED HOTELS [#EIHAHOTELS]

Market Cap: Rs. 1,534 Cr.

TREND GUIDE:

Breakout above Consolidation Base: NO

Good Buying Momentum : YES

Good Volume Build-up: YES

Stage 2 Advancing Phase: YES

Institutional Footprint: YES

Strong Sector: YES

Good Relative Strength: YES

No / Minimal Overhead Supply: NO

FINAL JUDGMENT: NOT LOOKING GOOD

TAJ GVK HOTELS [#TAJGVK]

Market Cap: Rs. 1,485 Cr.

TREND GUIDE:

Breakout above Consolidation Base: YES

Good Buying Momentum : YES

Good Volume Build-up: YES

Stage 2 Advancing Phase: YES

Institutional Footprint: YES

Strong Sector: YES

Good Relative Strength: YES

No / Minimal Overhead Supply: YES

FINAL JUDGMENT: LOOKING VERY GOOD

ROYAL ORCHID HOTELS [#ROHLTD]

Market Cap: Rs. 989 Cr.

TREND GUIDE:

Breakout above Consolidation Base: YES

Good Buying Momentum : YES

Good Volume Build-up: YES

Stage 2 Advancing Phase: YES

Institutional Footprint: YES

Strong Sector: YES

Good Relative Strength: YES

No / Minimal Overhead Supply: YES

FINAL JUDGMENT: LOOKING VERY GOOD

KAMAT HOTELS INDIA [#KAMATHOTEL]

Market Cap: Rs. 446 Cr.

TREND GUIDE:

Breakout above Consolidation Base: YES

Good Buying Momentum : YES

Good Volume Build-up: YES

Stage 2 Advancing Phase: YES

Institutional Footprint: YES

Strong Sector: YES

Good Relative Strength: YES

No / Minimal Overhead Supply: NO

FINAL JUDGMENT: LOOKING GOOD

ADVANI HOTELS RESTAURANTS [#ADVANIHOTR]

Market Cap: Rs. 405 Cr.

TREND GUIDE:

Breakout above Consolidation Base: NO

Good Buying Momentum : NO

Good Volume Build-up: NO

Stage 2 Advancing Phase: NO

Institutional Footprint: NO

Strong Sector: YES

Good Relative Strength: YES

No / Minimal Overhead Supply: NO

FINAL JUDGMENT: NOT LOOKING GOOD

APOLLO SINDOORI HOTELS [#APOLSINHOT]

Market Cap: Rs. 387 Cr.

TREND GUIDE:

Breakout above Consolidation Base: YES

Good Buying Momentum : YES

Good Volume Build-up: YES

Stage 2 Advancing Phase: YES

Institutional Footprint: YES

Strong Sector: YES

Good Relative Strength: YES

No / Minimal Overhead Supply: NO

FINAL JUDGMENT: LOOKING GOOD

ASIAN HOTELS NORTH [#ASIANHOTNR]

Market Cap: Rs. 311 Cr.

TREND GUIDE:

Breakout above Consolidation Base: YES

Good Buying Momentum : YES

Good Volume Build-up: YES

Stage 2 Advancing Phase: YES

Institutional Footprint: YES

Strong Sector: YES

Good Relative Strength: YES

No / Minimal Overhead Supply: NO

FINAL JUDGMENT: LOOKING VERY GOOD

ASIAN HOTELS EAST [#AHLEAST]

Market Cap: Rs. 200 Cr.

TREND GUIDE:

Breakout above Consolidation Base: NO

Good Buying Momentum : NO

Good Volume Build-up: NO

Stage 2 Advancing Phase: NO

Institutional Footprint: NO

Strong Sector: YES

Good Relative Strength: NO

No / Minimal Overhead Supply: NO

FINAL JUDGMENT: NOT LOOKING GOOD

SUMMARY

LOOKING VERY GOOD: [TOP GRADE]

INDIAN HOTELS

CHALET HOTELS

ORIENTAL HOTELS

TAJ GVK HOTELS

ROYAL ORCHID HOTELS

ASIAN HOTELS NORTH

LOOKING GOOD: [SECOND RUNG]

EIH LTD.

LEMON TREE HOTELS

MAHINDRA HOLIDAYS & RESORTS

KAMAT HOTELS INDIA

APOLLO SINDOORI HOTELS

NOT LOOKING GOOD: [AVOID]

INDIAN TOURISM DEVELOPMENT CORPORATION

EIH ASSOCIATED HOTELS

ADVANI HOTELS RESTAURANTS

ASIAN HOTELS EAST

CONCLUSION

It is always better to buy leading stocks from leading sectors.

Just because a sector is doing good does not mean that all the stocks in the sector are good. Some of them are not in a good shape because no one is buying them.

There is no point in bottom fishing or buying a beaten-down stock, hoping that some institution will start buying it.

Big Volumes coming into particular sector are never coincidences. Institutional activity usually happens in tandem within a sector or sub-sector. And, it always pays to go with the institutions.

It is always better to look at the price leaders which are set-up well;

After all, they are the leaders for a reason!!

The above is just for educational purposes. This is not an investment advice or recommendation to trade in these stocks.

#Stocks #Stockstowatch #Banking #Markets

The broad categorization for Hotel Stocks has been done using data from Market Smith India.