OVERVIEW

Credit Rating agencies are very central to the overall development of the economic and financial markets because these are the ones which act as providers of all critical information with regard to companies’ funding plans and sources.

With India positioning itself to become a $ 5 Trillion economy, there will be a lot of capex & investments required, which come along with a lot of fund raising. Credit Rating agencies are the ones which will tell everyone how the fund raise is rated, and whether it is worthwhile or not.

Fundamentally, prima facie, these agencies are poised to see a huge jump in business due to the above.

But, I would want to look at it technically as well.

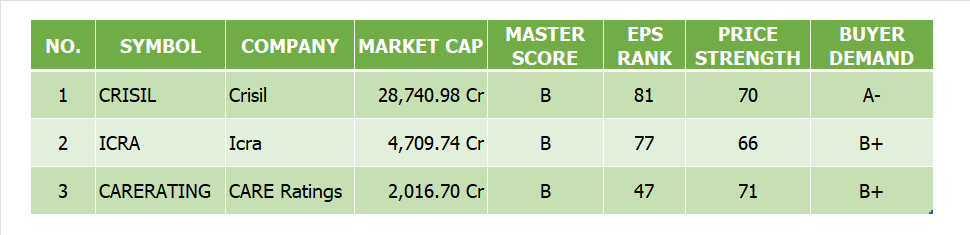

The below categorization gives concise, market-related data of all listed rating agencies in India.

If we were to treat this as a sub-sector, we can create a chart for the same by combining the listed entities. Let’s look at the combined chart (monthly frame) for Credit Rating agencies.

It has formed a gigantic Cup & Handle over approximately 76 months, which is about 6.33 years, and has finally broken out of the same. Moreover, it has also broken above the past lifetime highs (of April 2015) and is near ATH as of now. The Volume profile is also forming favourably. The depth of the cup suggests a potential upside of about 50 - 60% from current levels.

Now, that is worth exploring. Let’s dive right in!

ANALYSIS

CRISIL [#CRISIL]

TREND GUIDE

Breakout above Consolidation Base: YES

Good Buying Momentum : YES

Good Volume Build-up: YES

Stage 2 Advancing Phase: YES

Price Action Structure: HH-HL

Institutional Footprint: YES

Strong Sector: YES

Good Relative Strength: YES

No / Minimal Overhead Supply / near ATH: YES

COMMENTARY

Near ATH. Looking good for further upmove. Price action is quite clean.

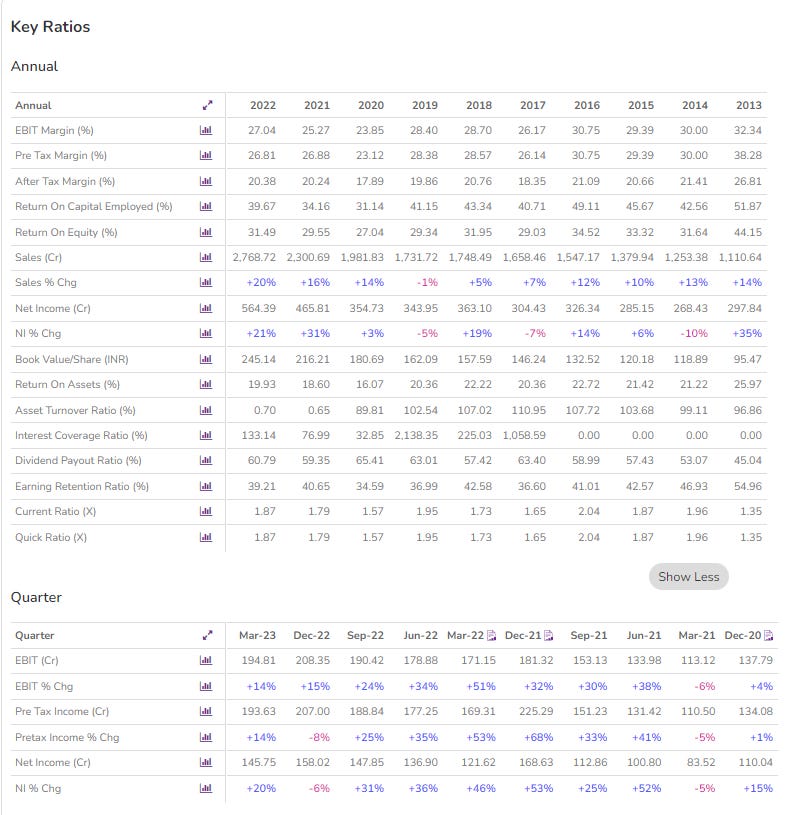

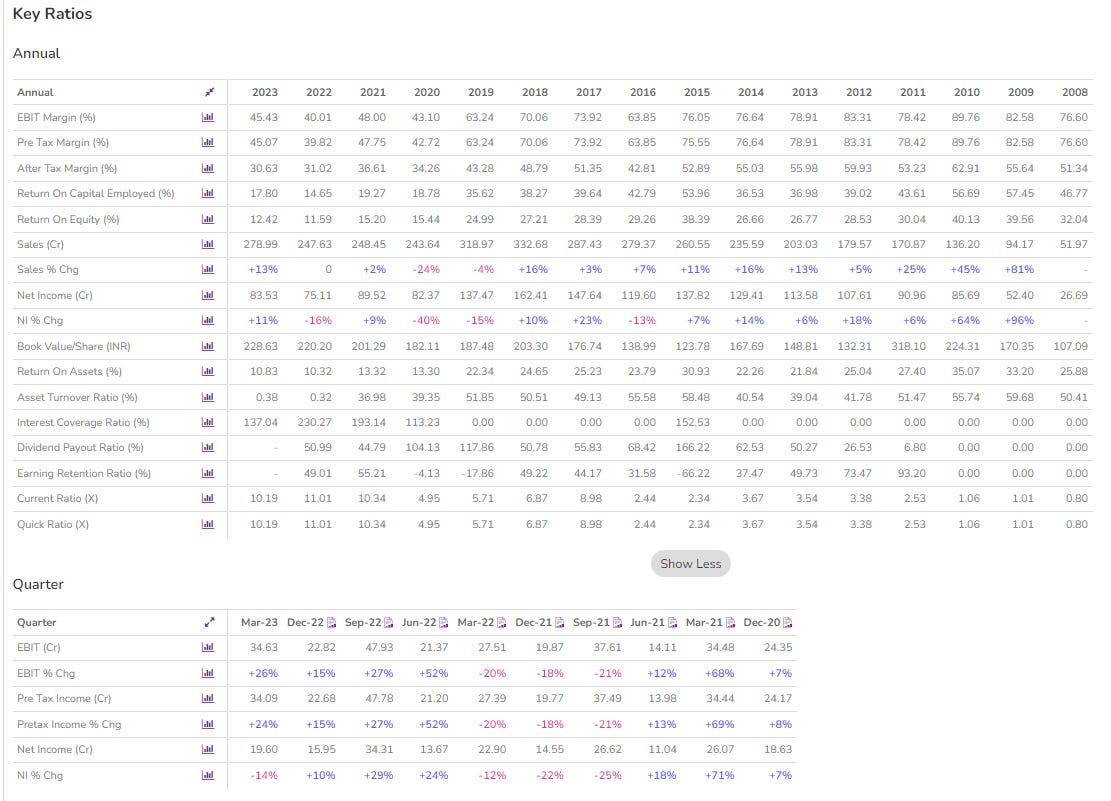

FINANCIALS

ICRA [#ICRA]

TREND GUIDE

Breakout above Consolidation Base: NO

Good Buying Momentum : NO

Good Volume Build-up: NO

Stage 2 Advancing Phase: YES

Price Action Structure: HH-HL

Institutional Footprint: NO

Strong Sector: YES

Good Relative Strength: PARTLY YES

No / Minimal Overhead Supply / near ATH: YES

COMMENTARY

Approaching the base breakout point. However, this one is a slow mover amongst the lot. However, price action is not too clean.

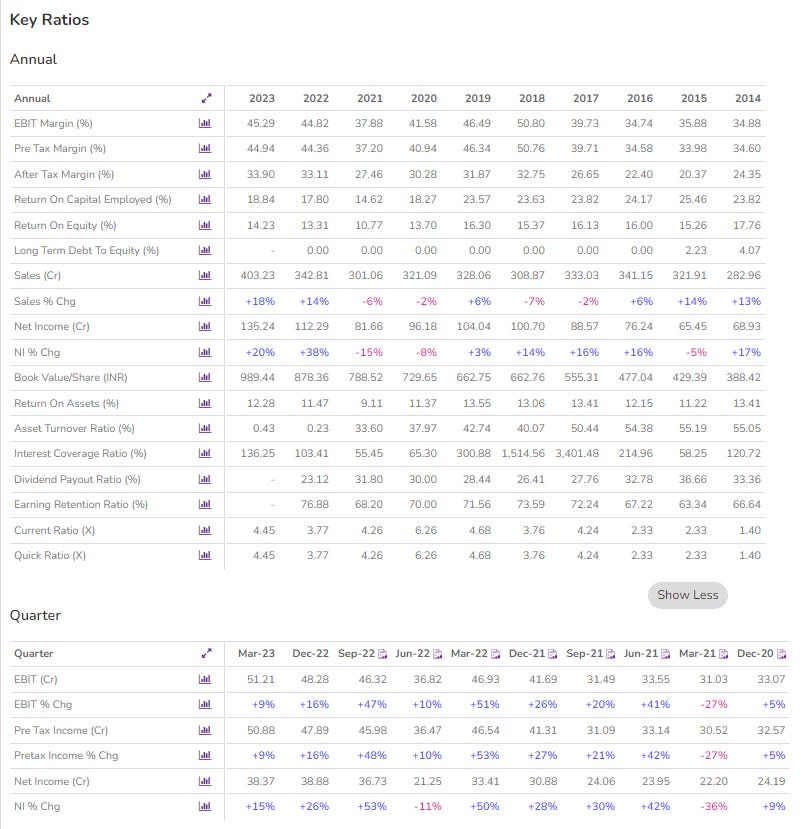

FINANCIALS

CARE RATINGS [#CARERATING]

TREND GUIDE

Breakout above Consolidation Base: YES

Good Buying Momentum : YES

Good Volume Build-up: YES

Stage 2 Advancing Phase: YES

Price Action Structure: HH-HL

Institutional Footprint: PARTLY YES

Strong Sector: YES

Good Relative Strength: YES

No / Minimal Overhead Supply / near ATH: NO

COMMENTARY

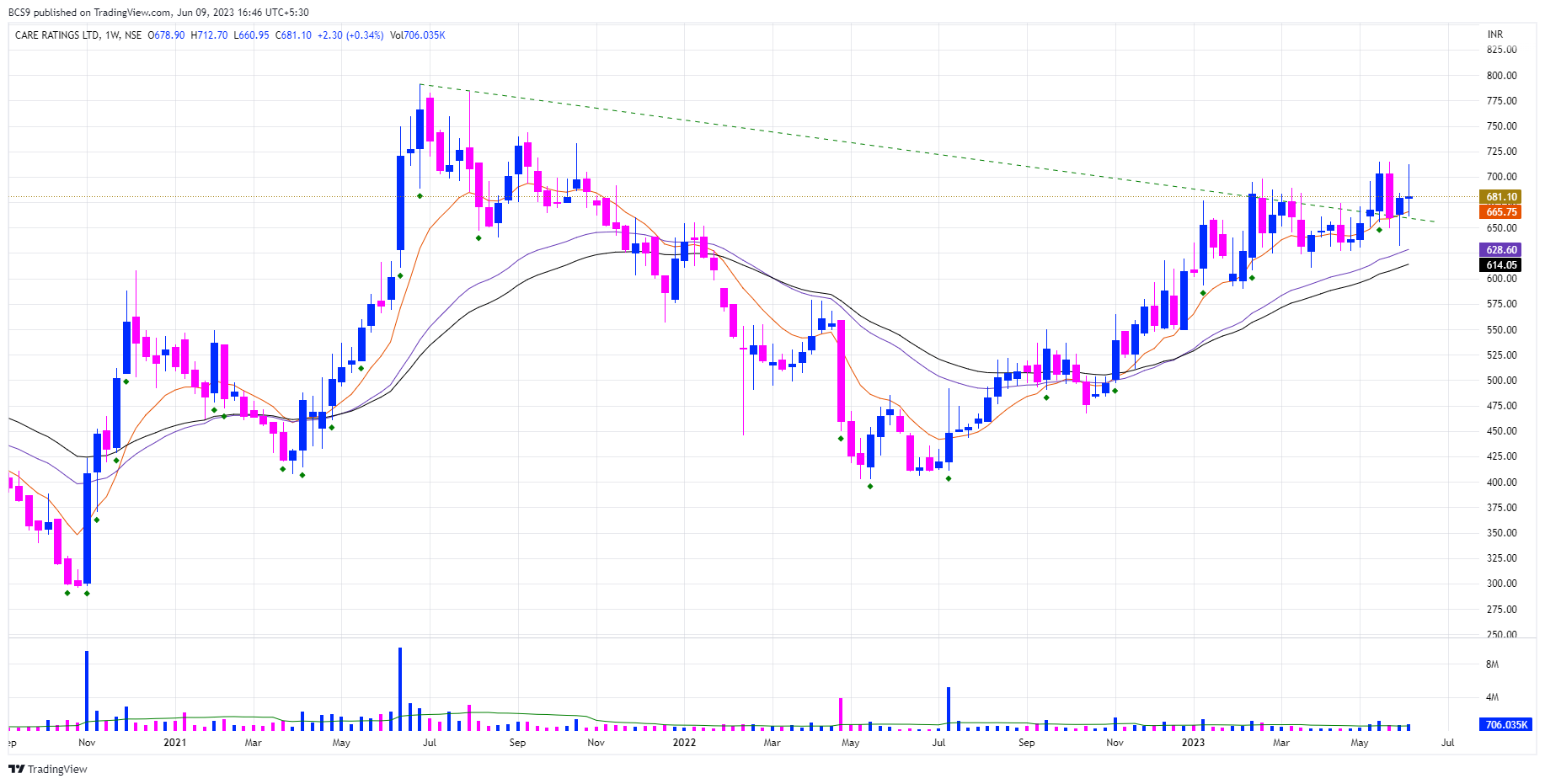

Stock is set up well. Price action is quite clean. However, there is a lot of overhead supply.

FINANCIALS

SUMMARY

CRISIL is clearly the market leader in this sector by a wide margin and that is reflecting in its chart & financials as well. No wonder, it pays to go with the leader.

ICRA has a few factors going against it as of now, biggest amongst them being a lack of volumes & Institutional Interest.

CARE is also set-up well and looks like it can also give some big moves going forward.

CRISIL & CARE are definitely in my watchlist!

Even if one chooses to buy all 3 in equal proportions, we have seen how the combined chart is all set up (presented in the overview).

So, there are many options to take part in the rally in this sector.

View some of my past Powerful Ideas which have performed extremely well.

NOTE:

All financial data and categorizations have been generated using Market Smith India.

1st chart in each individual stock is of a monthly frame and the 2nd is of a weekly frame.

Moving Averages used: Monthly frame - 10 Monthly EMA (Black). Weekly frame - 10 Weekly (Orange), 30 Weekly (Purple) & 40 Weekly (Black)

DISCLAIMER

All information provided here is for educational purposes only and does not constitute any investment advice or recommendation. Please do your own due diligence. Products mentioned are not recommendations. The author has no incentive, financial or otherwise, to write about any particular Stock / AMC / ETF. All data taken is the latest to the best of the author’s knowledge.

Yo sigo siendo pobre,por culpa de los bancos,no me dan crédito.figuro moroso , con sentencia mi favor... gracias...