ADITYA BIRLA CAPITAL

#ABCAPITAL

Good buying Force

Stock in Stage 2 Advancing phase

Breakout & re-test seems to be complete from recent base

Good Relative Strength

Good volume build up

Very strong close last week with big seller rejection

ANUPAM RASAYAN INDIA LTD.

#ANURAS

Very good buying force

Good volume build up

Stock in Stage 2 Advancing phase

Good Relative Strength

Breakout & re-test seems to be complete

Consolidation near 10 Weekly MA with volumes thinning out

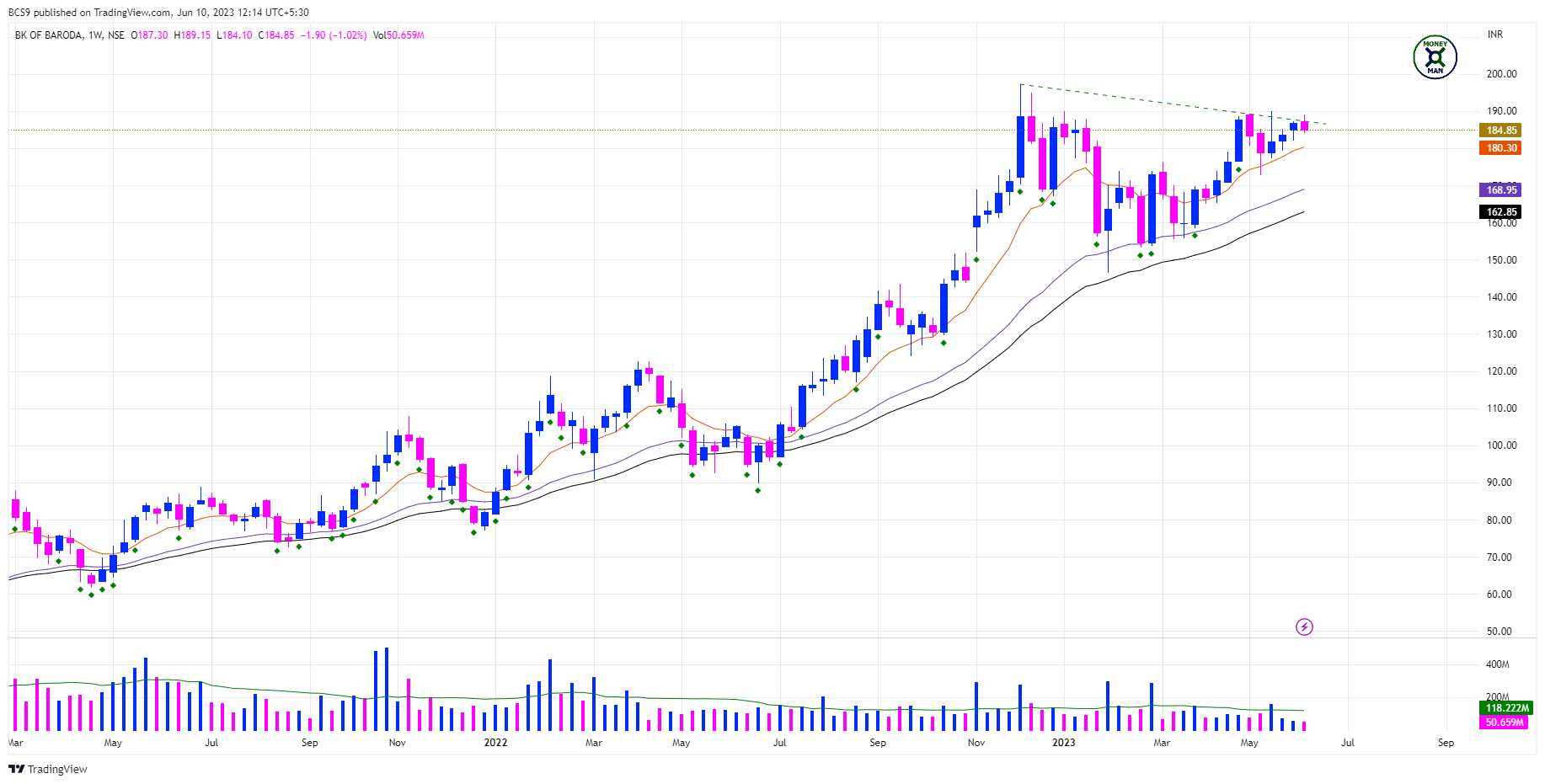

BANK OF BARODA

#BANKBARODA

Very good buying force

Good volume build up

Stock in Stage 2 Advancing phase

Good Relative Strength

Entire sector is setting up well for next upmove

Nearing trendline breakout point

Consolidation near 10 Weekly MA with volumes thinning out

CANARA BANK

#CANBK

Very good buying force

Good volume build up

Stock in Stage 2 Advancing phase

Good Relative Strength

Entire sector is setting up well for next upmove

Nearing trendline breakout point

Consolidation near 10 Weekly MA with volumes thinning out

EMUDHRA LTD.

#EMUDHRA

Very good buying force

Good volume build up

Stock just entering early Stage 2 Advancing phase

Good Relative Strength

Break-out & re-test of base seems to be done

Big seller rejection last week

Near ATH

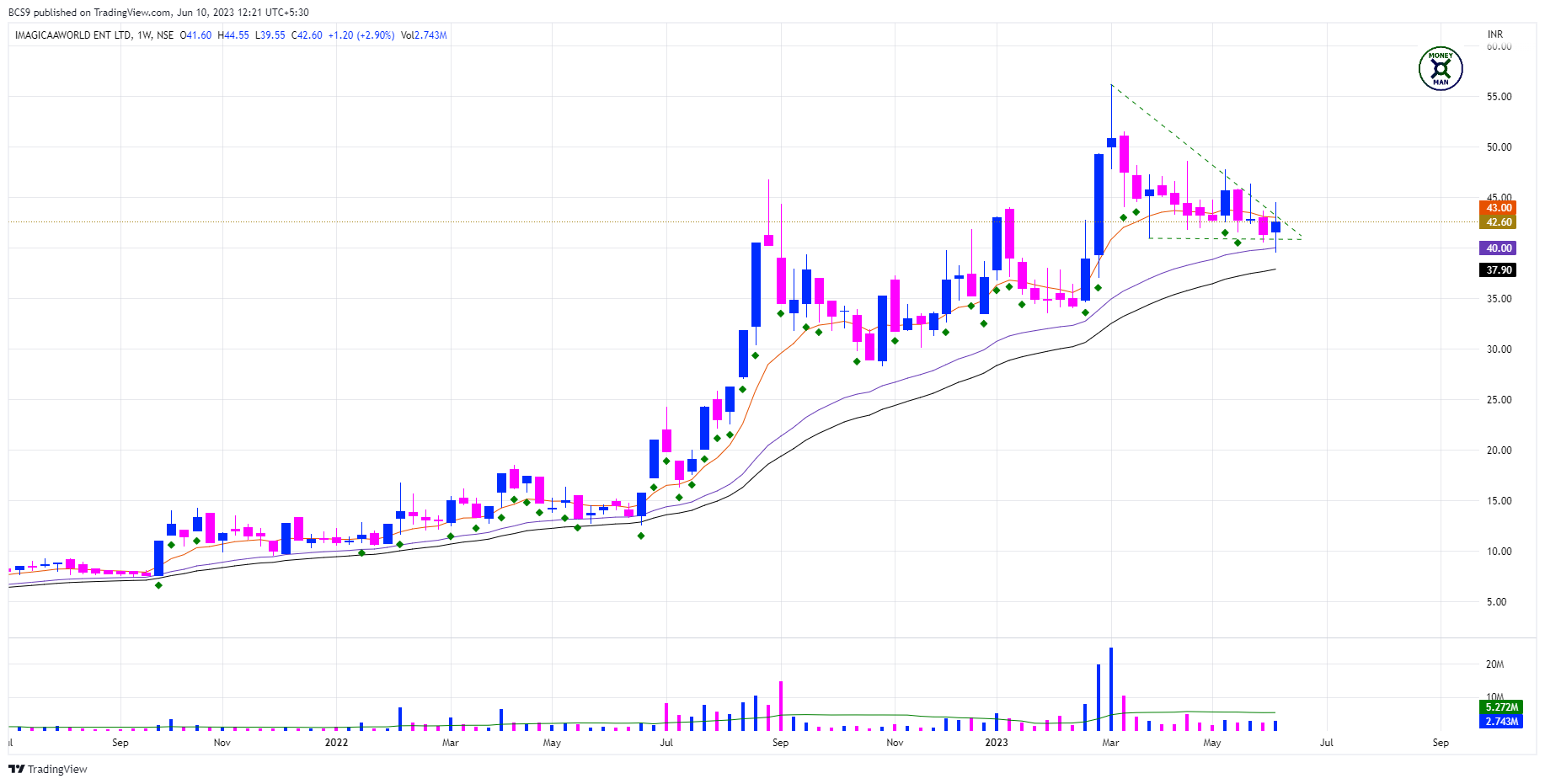

IMAGICAAWORLD ENT

#IMAGICAA

Very good buying force

Good volume build up

Stock in Stage 2 Advancing phase

Good Relative Strength

Coming to the end of a Triangle consolidation

Near 10 Weekly MA with volumes thinning out

Positive only if it breaks out on the upside. Breakdown can be very negative.

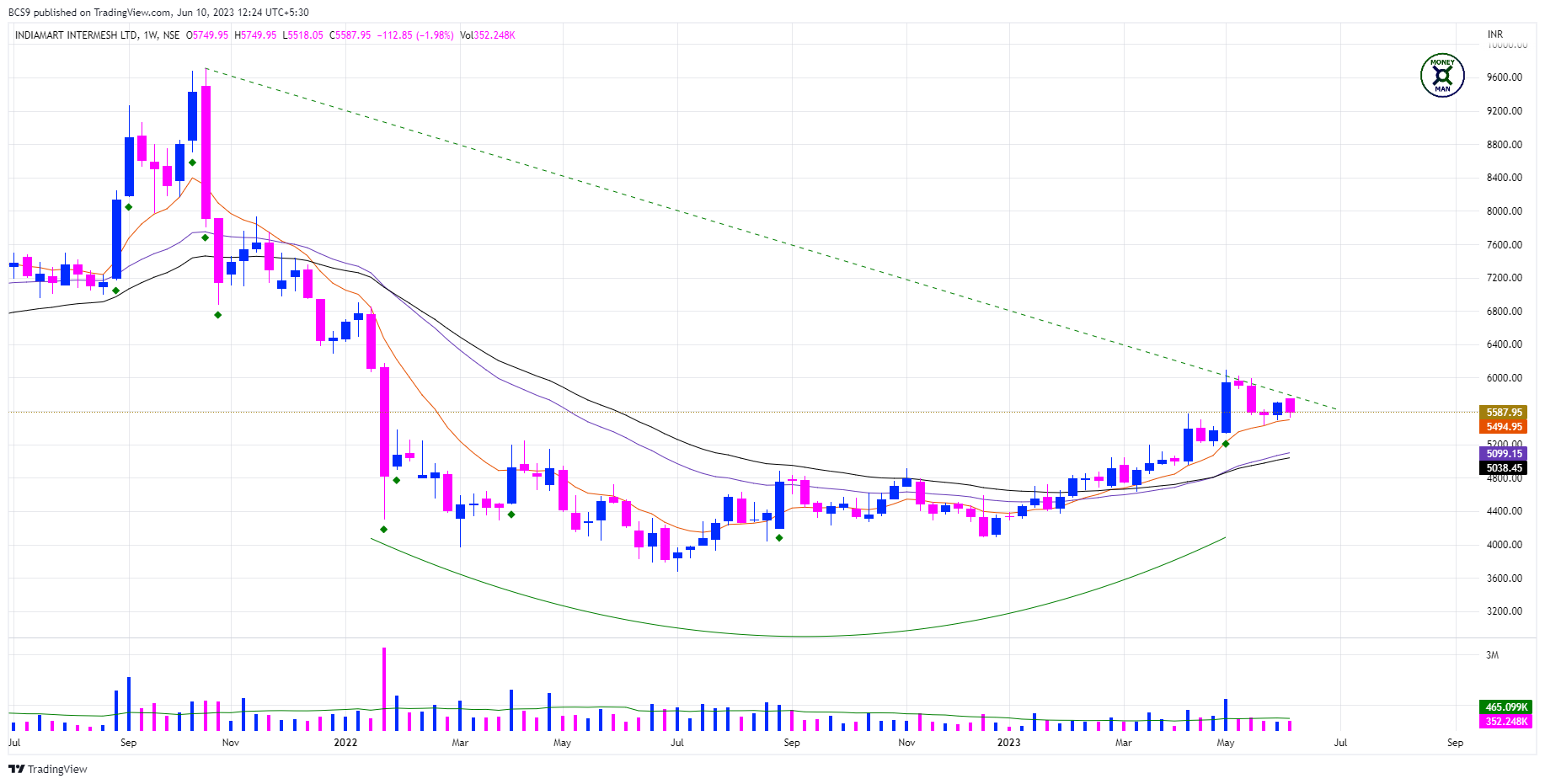

INDIAMART INTERMESH

#INDIAMART

Very good buying force

Stock in early Stage 2 Advancing phase

Good Relative Strength

Approaching a long term sloping trendline for a possible breakout

Consolidation near 10 Weekly MA with volumes thinning out

Nice rounding bottom formation

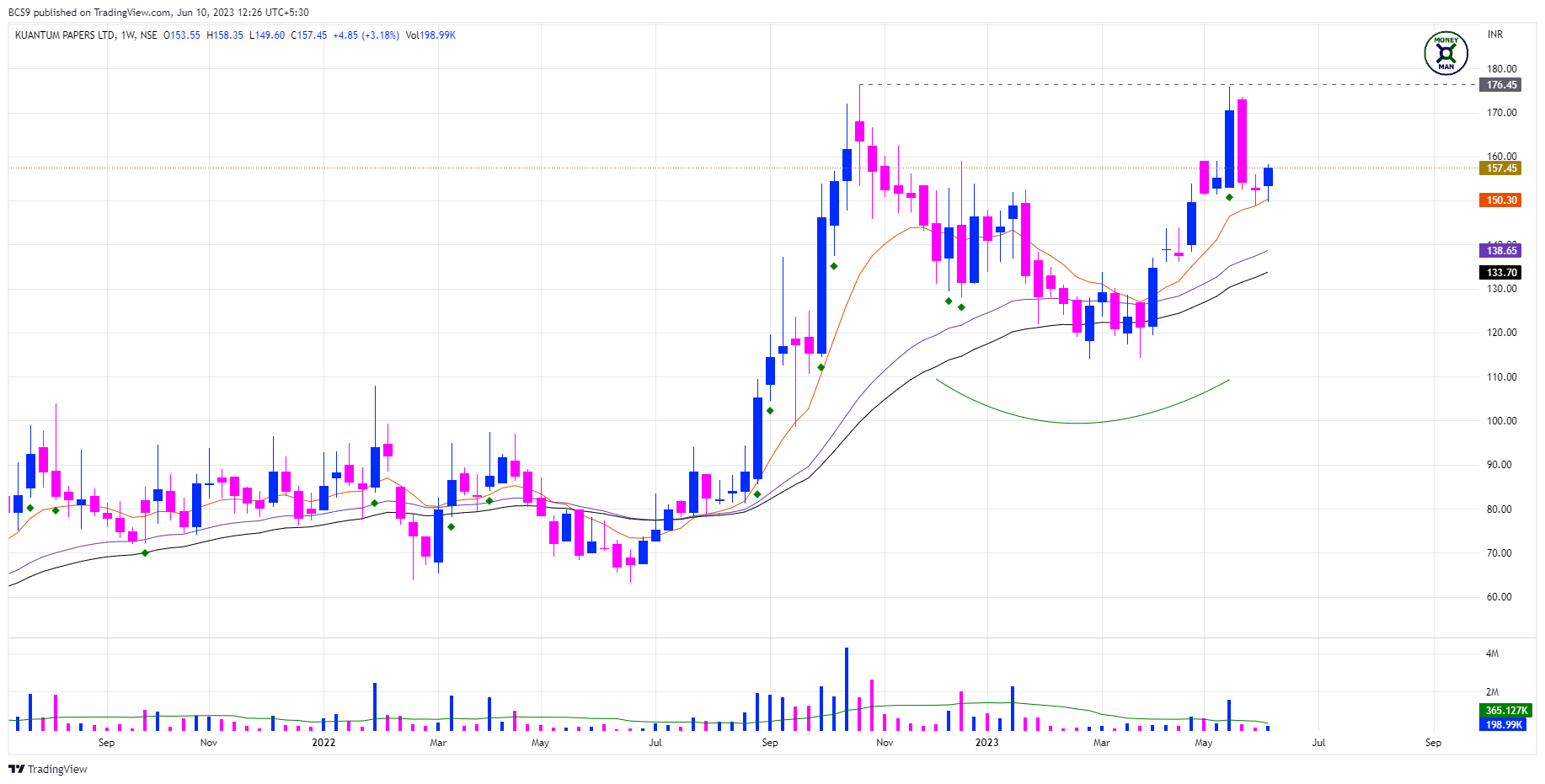

KUANTUM PAPERS

#KUANTUM

Very good buying force

Stock in Stage 2 Advancing phase

Good Relative Strength

Good previous volume build up

Consolidation near 10 Weekly MA with volumes thinning out

Seems to have formed a Cup and may try to form the Handle part of it by moving upwards

MOLD-TEK TECHNOLOGIES

#MOLDTECH

Very good buying force

Stock in a solid Stage 2 Advancing phase

Good Relative Strength

Cam back to test the 10 Weekly MA last week and then gave a solid seller rejection. Has also been respecting the 10 Weekly since a long time

Last week’s down move was on reduced volumes

Near ATH

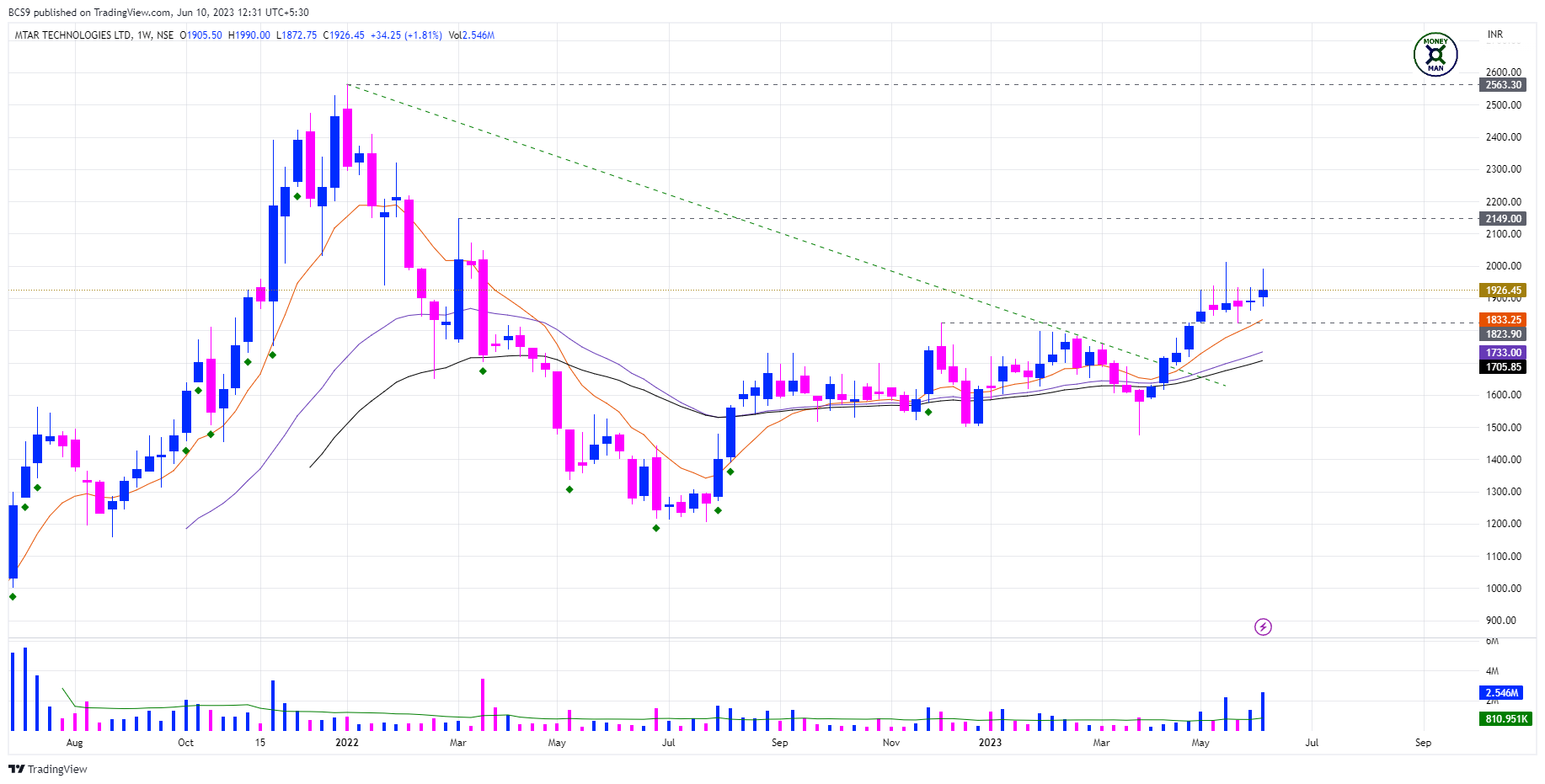

MTAR TECHNOLOGIES

#MTARTECH

Very good buying force

Stock in Stage 2 Advancing phase

Good Relative Strength

Very good volume build up

Consolidation near 10 Weekly MA

Price in narrow range with high volumes may indicate stock changing big hands

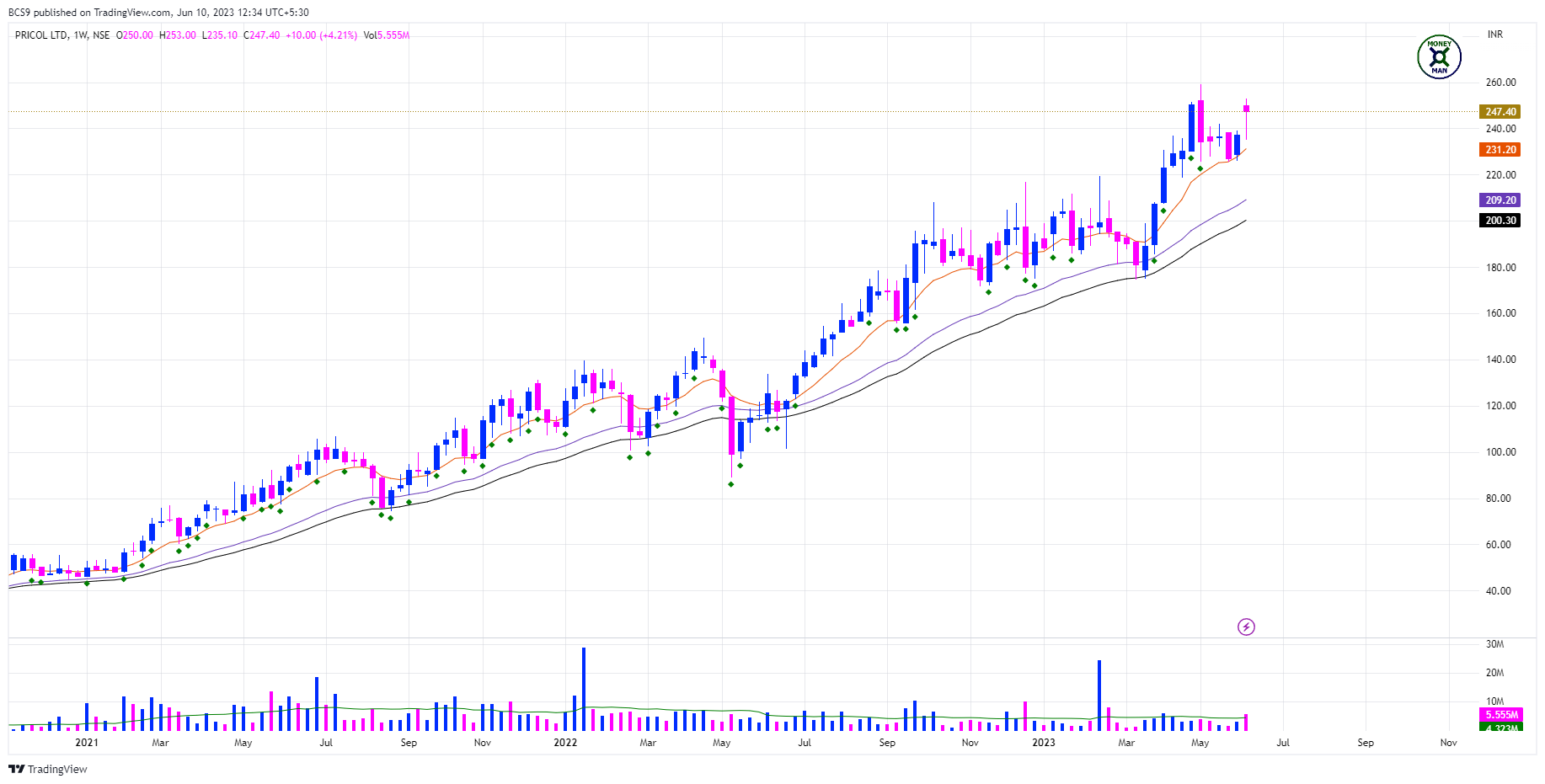

PRICOL LTD

#PRICOLLTD

Very good buying force

Stock in Stage 2 Advancing phase

Good Relative Strength

Gave a good seller rejection last week with good volumes and closed in the upper half of the weekly candle

Near ATH

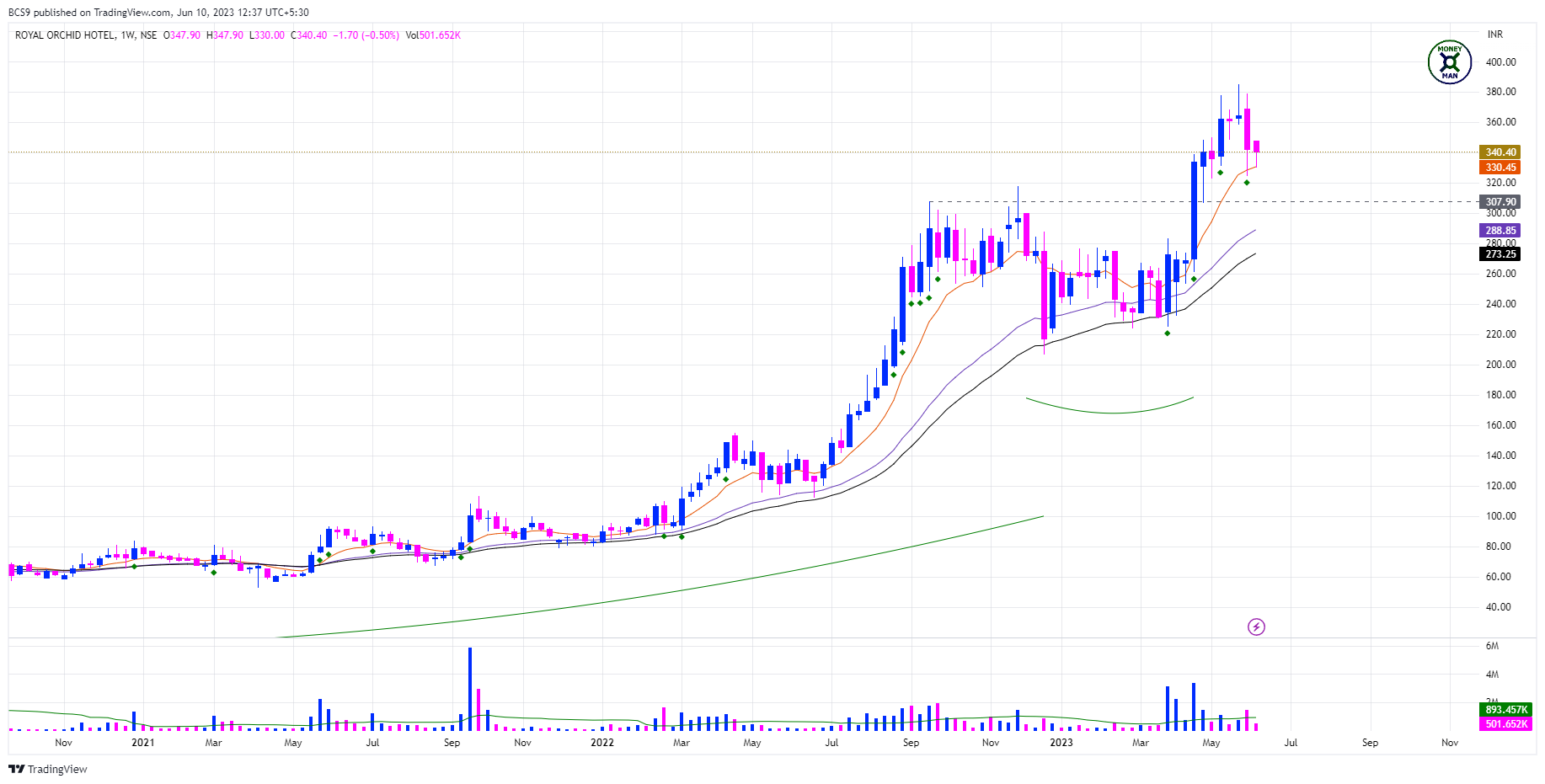

ROYAL ORCHID HOTEL

#ROHLTD

Very good buying force

Stock in a Stage 2 Advancing phase

Good Relative Strength

Breakout of base happened a few weeks back

Re-tested the 10 Weekly MA after a strong upmove

Has been giving seller rejections since the last 2 weeks

SUPREME INDUSTRIES

#SUPREMEIND

Very good buying force

Stock is in a Stage 2 Advancing phase

Good Relative Strength

Broke out of a Cup & Handle

Consolidating near 10 Weekly MA with narrow range & lower volumes

Near ATH

UCO BANK

#UCOBANK

Very good buying force

Good volume build up

Stock in Stage 2 Advancing phase

Good Relative Strength

Entire sector is setting up well for next upmove

Nearing trendline breakout point

Consolidation near 10 Weekly MA with volumes thinning out

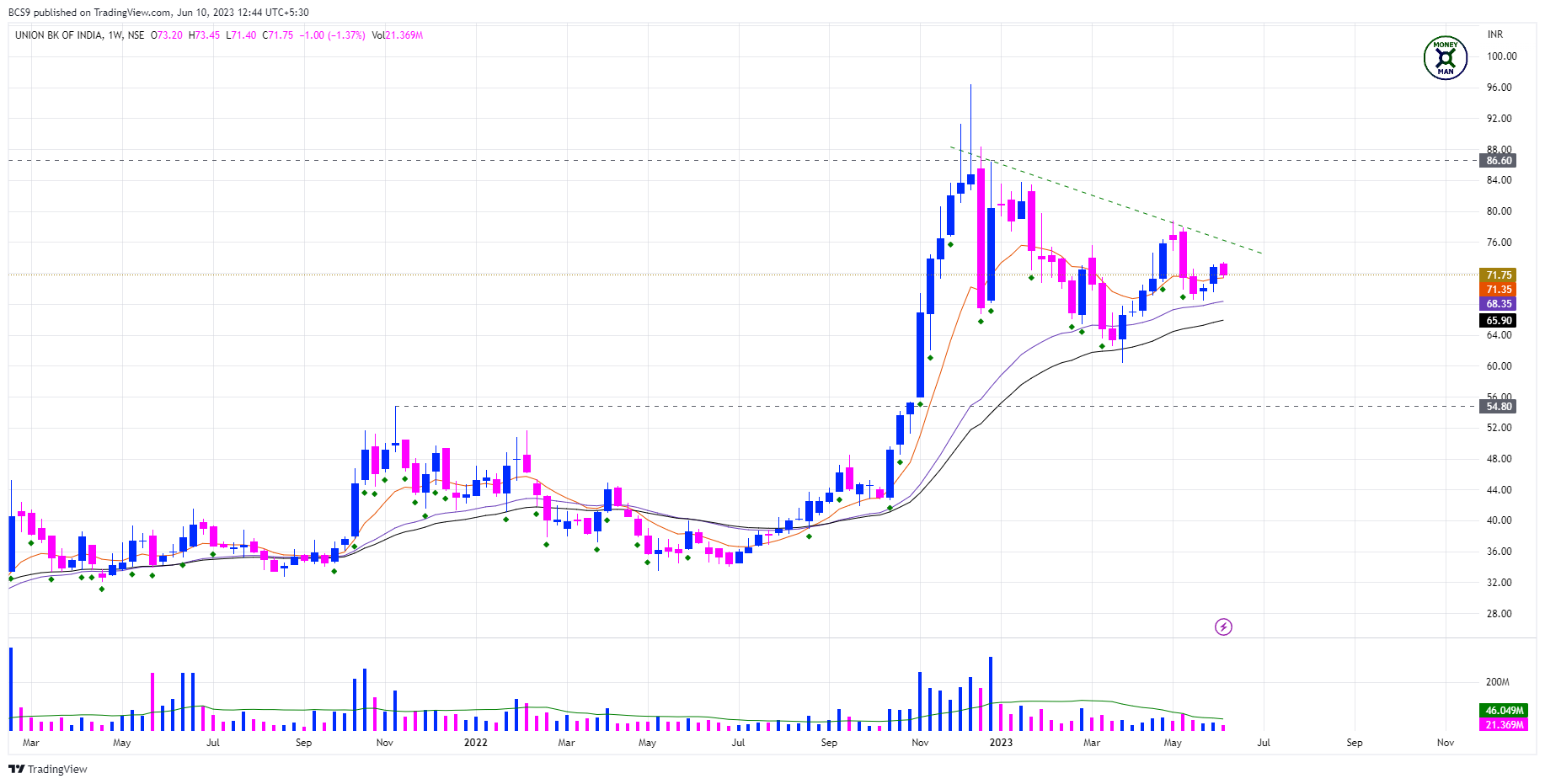

UNION BANK OF INDIA

#UNIONBANK

Very good buying force

Good volume build up

Stock in Stage 2 Advancing phase

Good Relative Strength

Entire sector is setting up well for next upmove

Nearing trendline breakout point

Consolidation near 10 Weekly MA with volumes thinning out

OTHER GOOD STUFF

My past Watchlists can be accessed here:

Just published an interesting study of Rating Agencies which seem to have given a multi-year breakout:

Hotel Stocks have been doing really well. Had published a report on the Hotel Stocks sometime back. You can read it here:

My latest study on leading & lagging sectors can be accessed here:

DISCLAIMER

The above is just a watchlist of stocks that I am tracking. All information provided here is for educational purposes only and does not constitute any investment advice or recommendation. Please do your own due diligence. Products mentioned are not recommendations. The author has no incentive, financial or otherwise, to write about any particular Stock / AMC / ETF. All data taken is the latest to the best of the author’s knowledge. This is published just for educational purposes. This is not an advice or a recommendation to trade in these or any other stocks.