POWERFUL IDEAS - PSU BANKS

WHICH ONES ARE ALL SET TO ATTRACT YOUR MONEY AND GROW IT FAST?

SECTOR OVERVIEW

PSU Banks have been laggards for many years. However, recently, they started reporting much better results and their financials have improved in a much bigger manner. I first spotted the potential of PSU Banks in Oct 2022, just when they were about to give a multi-year breakout. These Banks gave fast & furious moves for about 3 months, and then went into bases along with a dull / negative market.

Looks like they could be setting up again for a second round of fast upmoves!

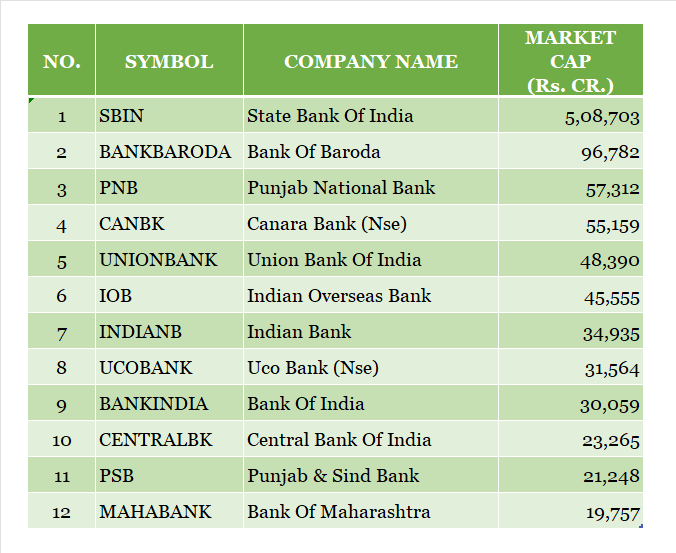

Let’s look at the universe of listed PSU Banks:

The below gives a technical picture of the overall PSU Banking space through Nifty PSU Bank.

On a monthly frame, it looks like Nifty PSU Bank has broken out of a 13+ year parallel channel and has re-tested the breakout as well. That indicates a huge upside in the coming times. On the weekly frame, it has been consolidating within a triangle in tight manner along the 10 Weekly MA and is going to run out of space within the next week or two. All MAs are stacked up well.

The above looks pretty well set-up as I had pointed out in my Sectoral Indices Rotation Watch a couple of weeks back.

Let’s look at an study of individual stocks in this sector (sorted as per Market Cap in a descending manner).

I prefer to rank the stocks into 3 categories as follows:

A: Good for deployment

B: Under watch

C: Avoid

Let’s dive in!

INDIVIDUAL ANALYSIS

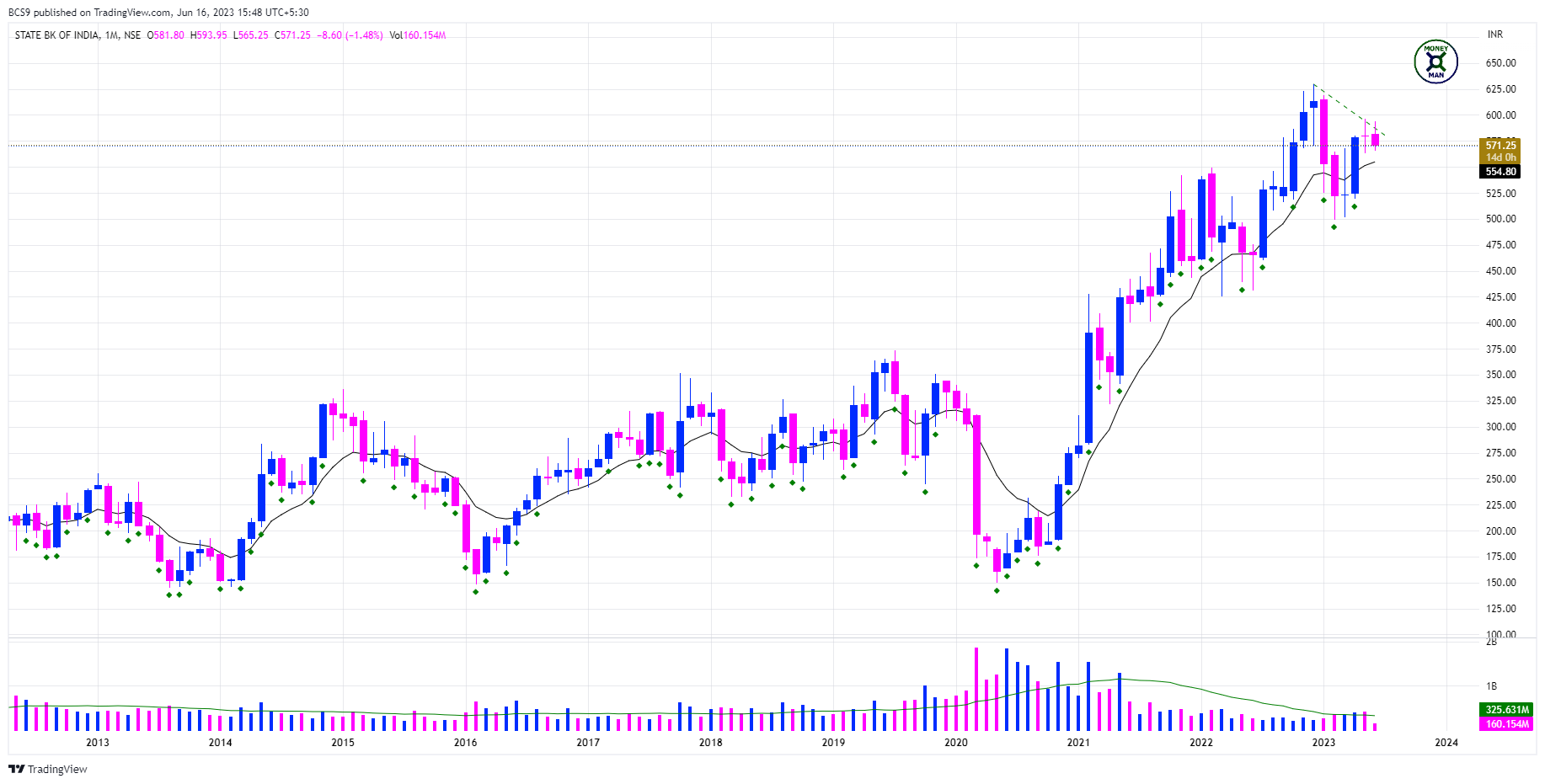

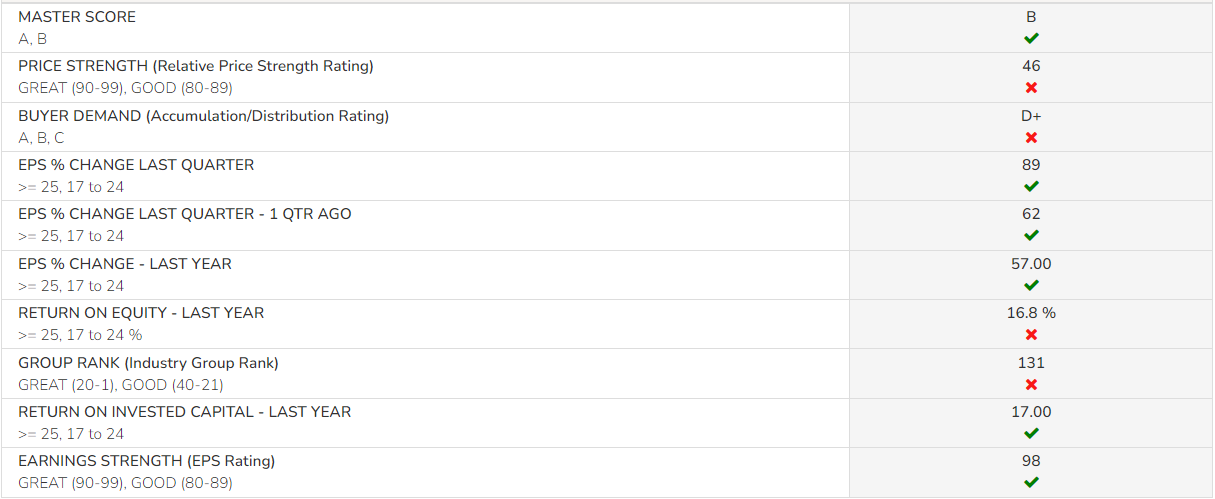

STATE BANK OF INDIA [#SBIN]

MONEYMAN TREND GUIDE

Breakout above Base / Trendline: NO

Good Buying Momentum: NO

Good Volume Build-up: NO

Stage 2 Advancing Phase: NO

Price Action Structure: HH-HL

Institutional Footprint: YES

Strong Sector: YES

Good Relative Strength: NO

Minimal Overhead Supply / near ATH: NO

COMMENTARY

Inspite of being the leader of the pack in terms of size, this is not exhibiting price leadership.

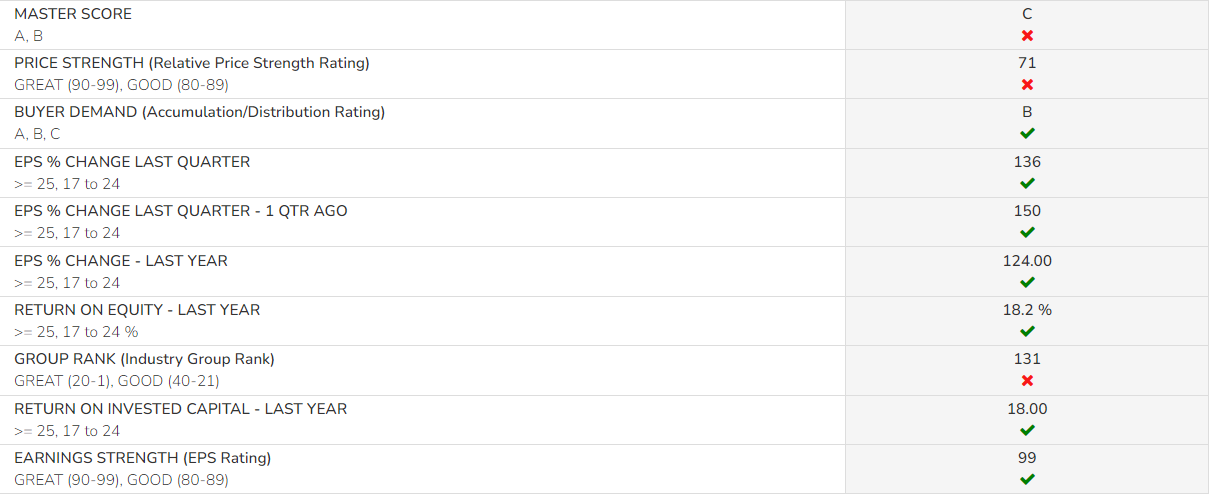

MONEYMAN FUNDA CHECK

RANKING: C

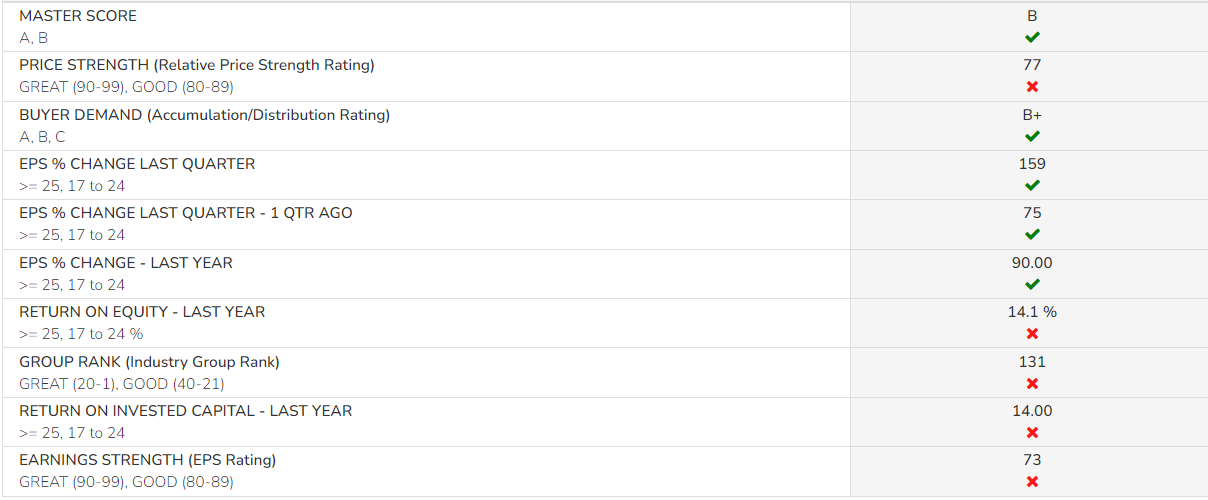

BANK OF BARODA [#BANKBARODA]

MONEYMAN TREND GUIDE

Breakout above Base / Trendline: NO

Good Buying Momentum: YES

Good Volume Build-up: YES

Stage 2 Advancing Phase: YES

Price Action Structure: HH-HL

Institutional Footprint: YES

Strong Sector: YES

Good Relative Strength: NO

Minimal Overhead Supply / near ATH: NO

COMMENTARY

This has set up extremely well and looks to be very close to the trendline breakout point.

MONEYMAN FUNDA CHECK

RANKING: A

PUNJAB NATIONAL BANK [#PNB]

MONEYMAN TREND GUIDE

Breakout above Base / Trendline: NO

Good Buying Momentum: NO

Good Volume Build-up: YES

Stage 2 Advancing Phase: EARLY STAGE

Price Action Structure: UNDER FORMATION

Institutional Footprint: NO

Strong Sector: YES

Good Relative Strength: NO

Minimal Overhead Supply / near ATH: NO

COMMENTARY

This one is just trying to break out of a broader base. There iss till a lot of work left in this.

MONEYMAN FUNDA CHECK

RANKING: B

CANARA BANK [#CANBK]

MONEYMAN TREND GUIDE

Breakout above Base / Trendline: NO

Good Buying Momentum: NO

Good Volume Build-up: NO

Stage 2 Advancing Phase: NO

Price Action Structure: UNDER FORMATION

Institutional Footprint: YES

Strong Sector: YES

Good Relative Strength: NO

Minimal Overhead Supply / near ATH: NO

COMMENTARY

Lot of whipsaw movements.

MONEYMAN FUNDA CHECK

RANKING: B

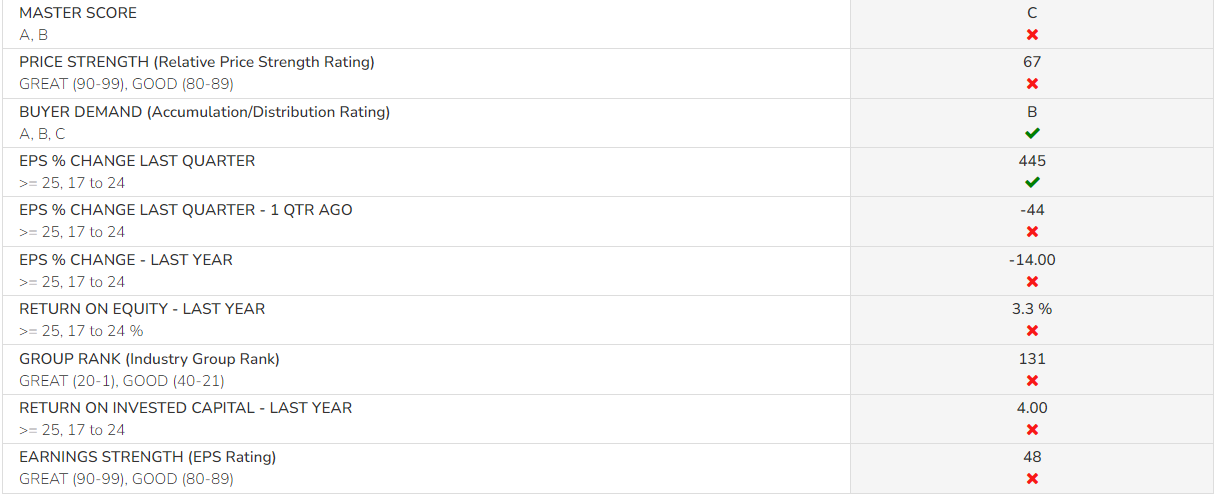

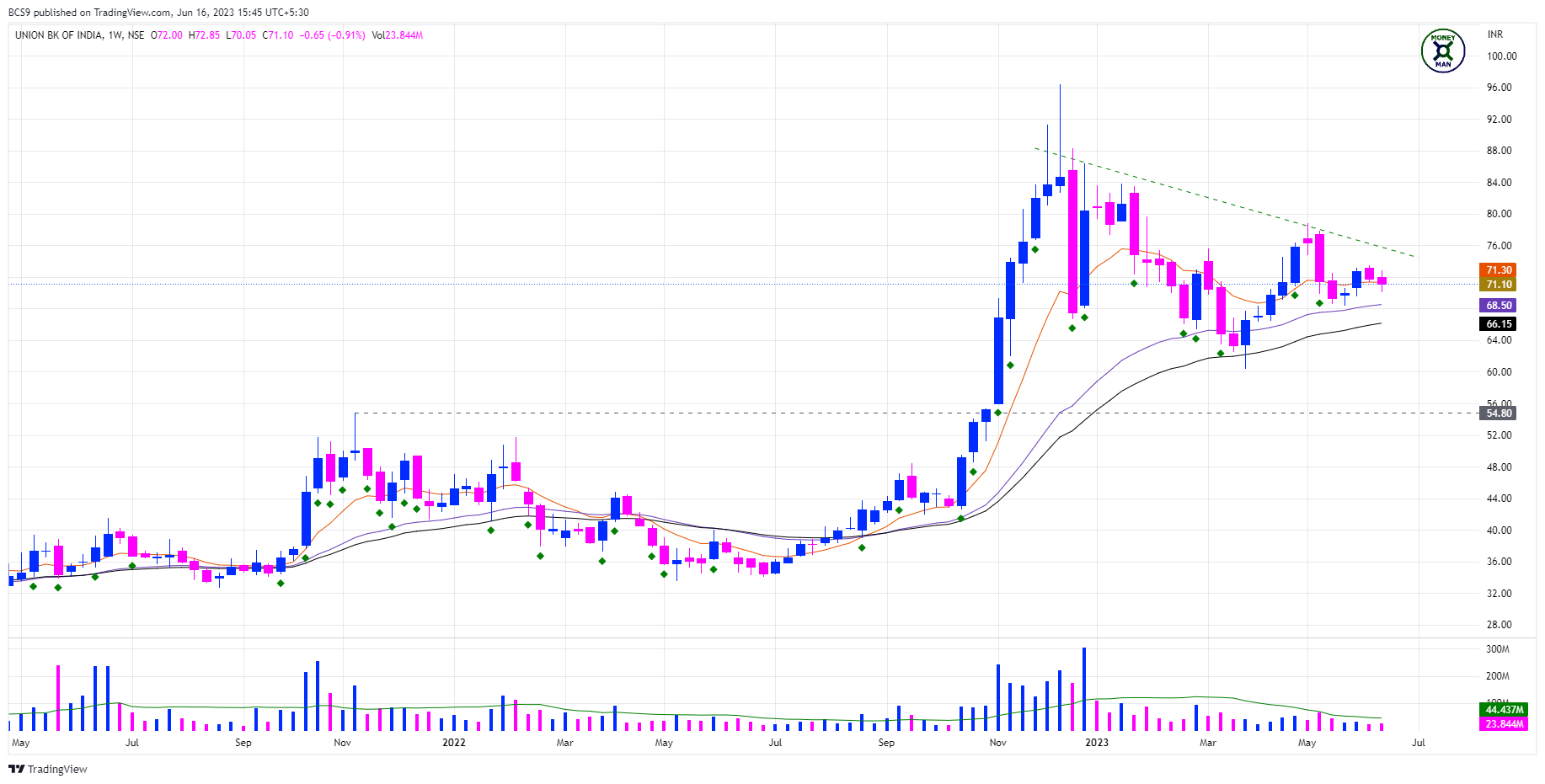

UNION BANK OF INDIA [#UNIONBANK]

MONEYMAN TREND GUIDE

Breakout above Base / Trendline: NO

Good Buying Momentum: NO

Good Volume Build-up: YES

Stage 2 Advancing Phase: EARLY STAGE

Price Action Structure: UNDER FORMATION

Institutional Footprint: YES

Strong Sector: YES

Good Relative Strength: NO

Minimal Overhead Supply / near ATH: NO

COMMENTARY

Looks set up well in both frames.

MONEYMAN FUNDA CHECK

RANKING: B

INDIAN OVERSEAS BANK [#IOB]

MONEYMAN TREND GUIDE

Breakout above Base / Trendline: NO

Good Buying Momentum: NO

Good Volume Build-up: NO

Stage 2 Advancing Phase: NO

Price Action Structure: UNDER FORMATION

Institutional Footprint: NO

Strong Sector: YES

Good Relative Strength: NO

Minimal Overhead Supply / near ATH: NO

COMMENTARY

Still a long way to go before it sets up.

MONEYMAN FUNDA CHECK

RANKING: C

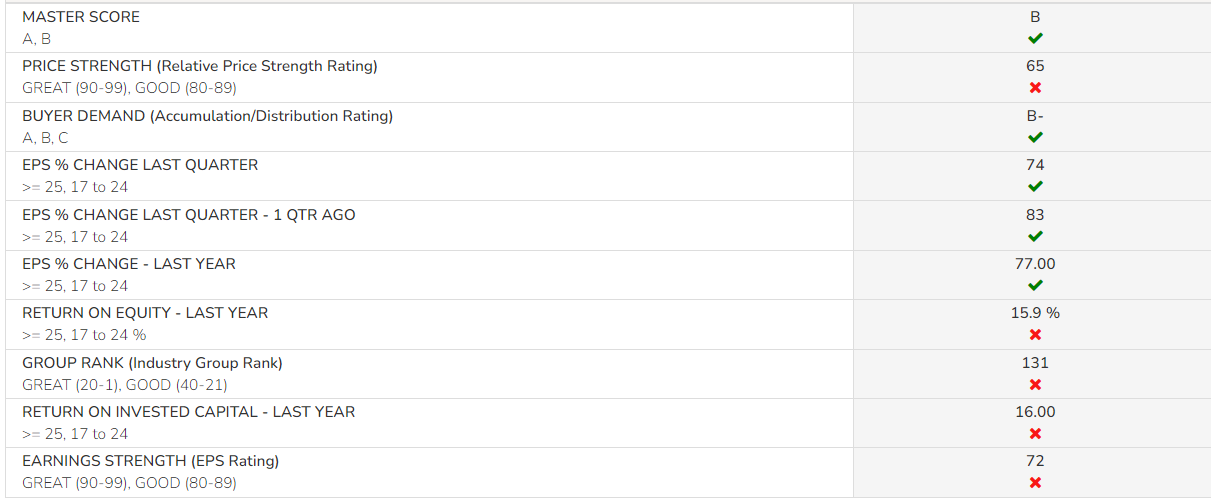

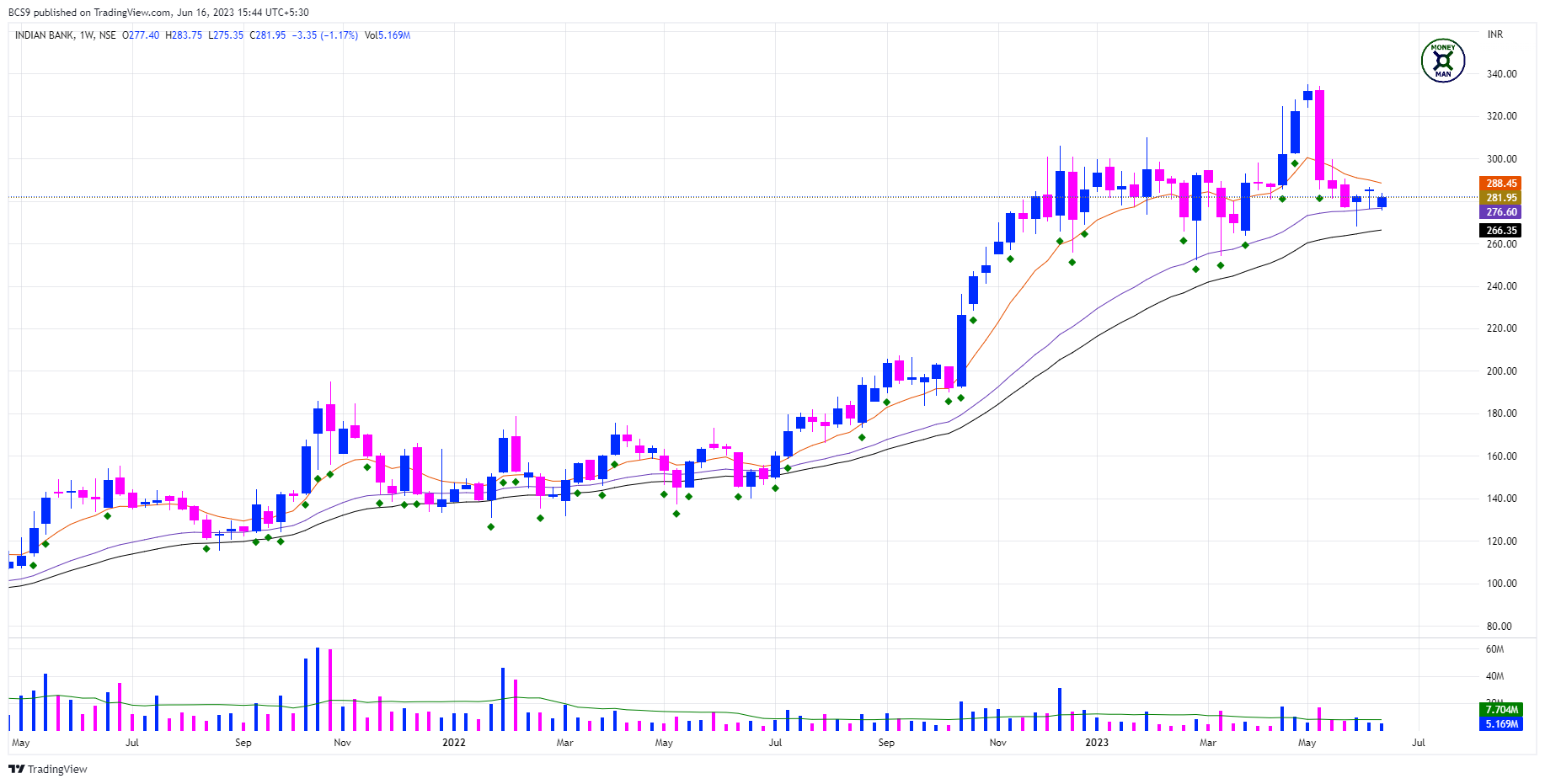

INDIAN BANK [#INDIANB]

MONEYMAN TREND GUIDE

Breakout above Base / Trendline: NO

Good Buying Momentum: YES

Good Volume Build-up: YES

Stage 2 Advancing Phase: NO

Price Action Structure: HH-HL

Institutional Footprint: YES

Strong Sector: YES

Good Relative Strength: NO

Minimal Overhead Supply / near ATH: NO

COMMENTARY

Was one of the past price leaders.

MONEYMAN FUNDA CHECK

RANKING: C

UCO BANK [#UCOBANK]

MONEYMAN TREND GUIDE

Breakout above Base / Trendline: NO

Good Buying Momentum: NO

Good Volume Build-up: NO

Stage 2 Advancing Phase: YES

Price Action Structure: UNDER FORMATION

Institutional Footprint: NO

Strong Sector: YES

Good Relative Strength: NO

Minimal Overhead Supply / near ATH: NO

COMMENTARY

It is at an interesting juncture. A breakout can lead to a big upmove.

MONEYMAN FUNDA CHECK

RANKING: B

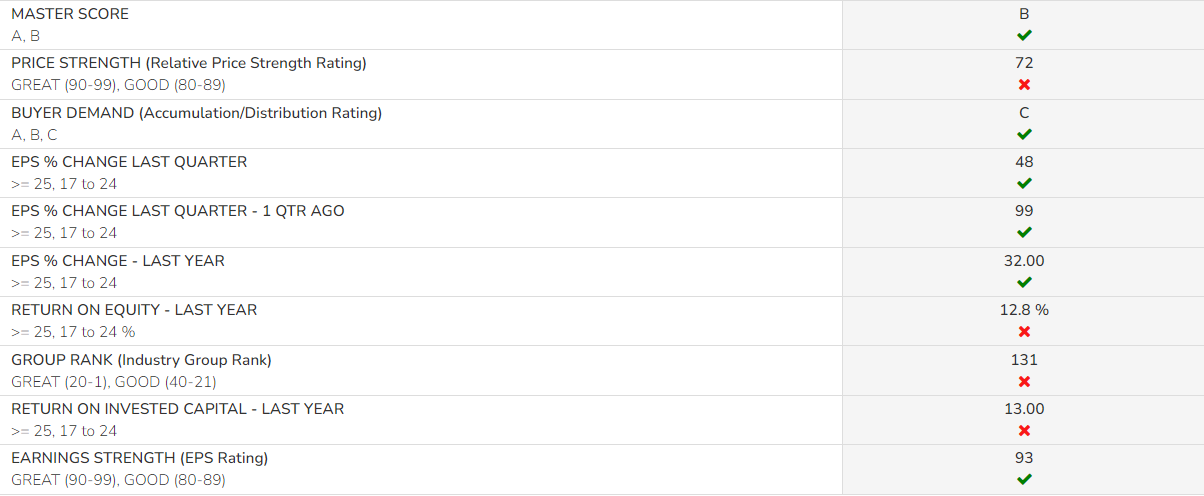

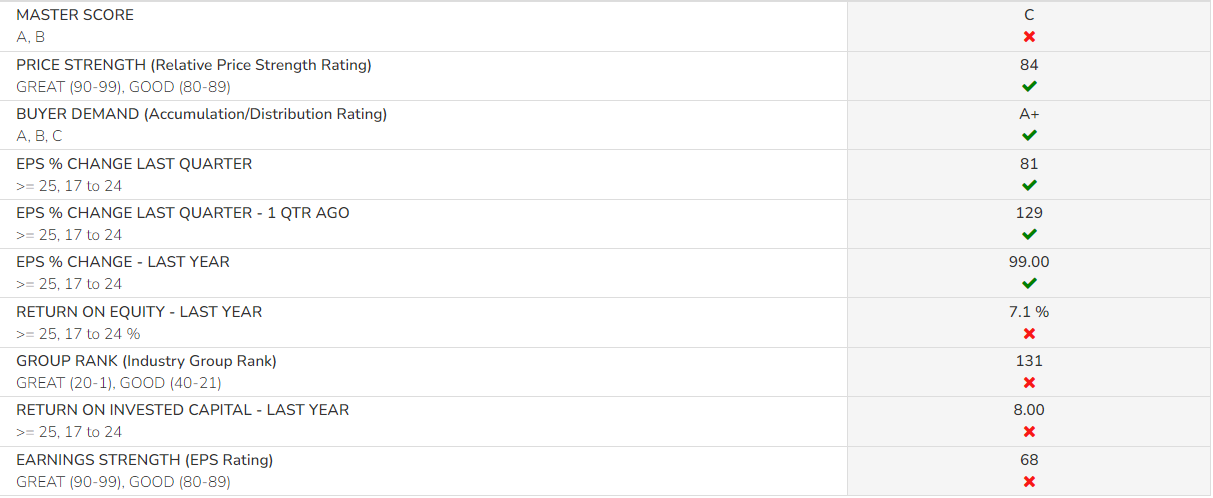

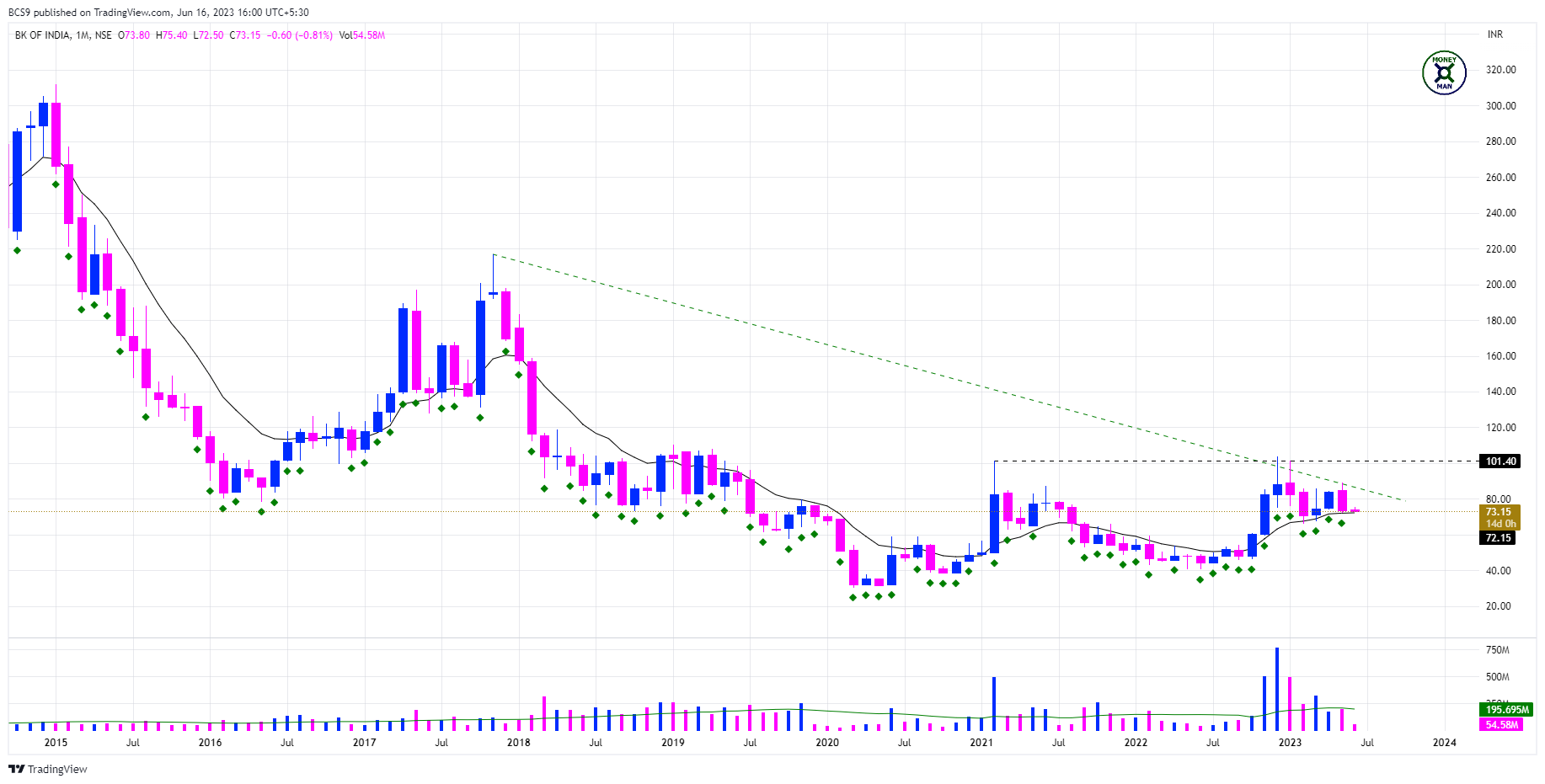

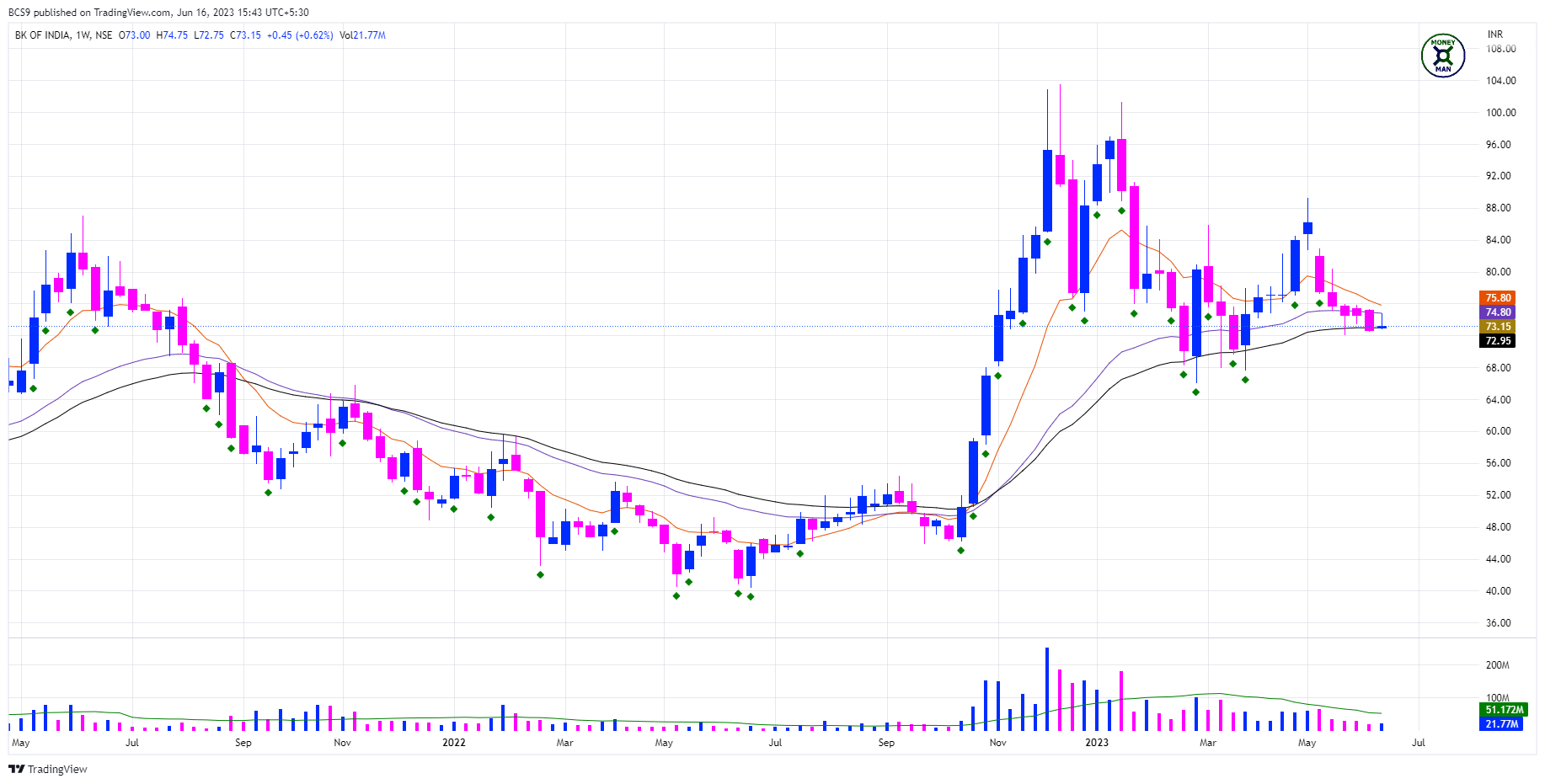

BANK OF INDIA [#BANKINDIA]

MONEYMAN TREND GUIDE

Breakout above Base / Trendline: NO

Good Buying Momentum: NO

Good Volume Build-up: NO

Stage 2 Advancing Phase: NO

Price Action Structure: UNDER FORMATION

Institutional Footprint: NO

Strong Sector: YES

Good Relative Strength: NO

Minimal Overhead Supply / near ATH: NO

COMMENTARY

Lot of factors going against the stock as of now.

MONEYMAN FUNDA CHECK

RANKING: C

CENTRAL BANK OF INDIA [#CENTRALBK]

MONEYMAN TREND GUIDE

Breakout above Base / Trendline: NO

Good Buying Momentum: NO

Good Volume Build-up: NO

Stage 2 Advancing Phase: NO

Price Action Structure: UNDER FORMATION

Institutional Footprint: NO

Strong Sector: YES

Good Relative Strength: NO

Minimal Overhead Supply / near ATH: NO

COMMENTARY

Lot of factors going against the stock as of now.

MONEYMAN FUNDA CHECK

RANKING: C

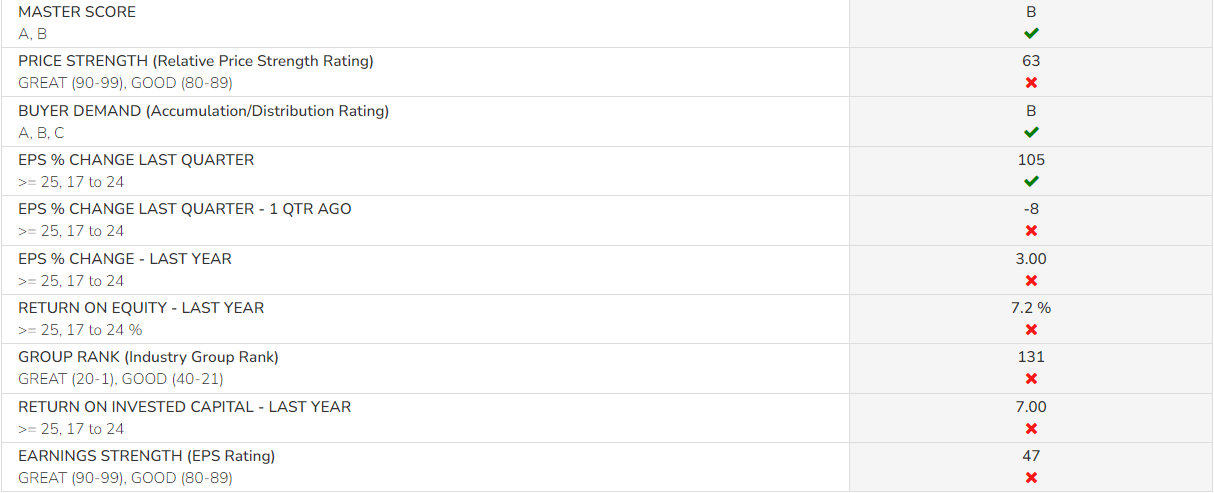

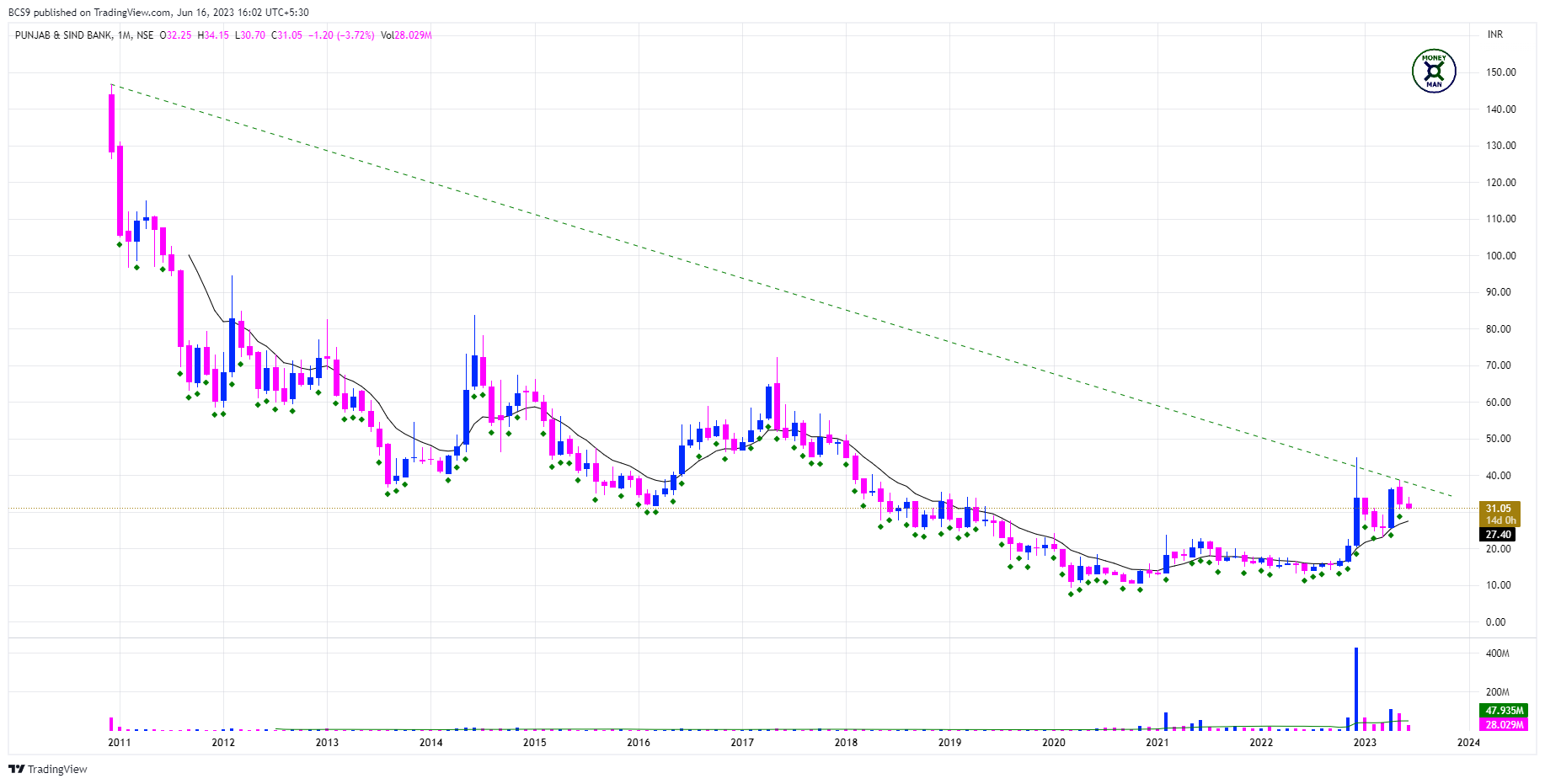

PUNJAB & SIND BANK [#PSB]

MONEYMAN TREND GUIDE

Breakout above Base / Trendline: NO

Good Buying Momentum: YES

Good Volume Build-up: YES

Stage 2 Advancing Phase: EARLY STAGE

Price Action Structure: UNDER FORMATION

Institutional Footprint: YES

Strong Sector: YES

Good Relative Strength: YES

Minimal Overhead Supply / near ATH: NO

COMMENTARY

Stock is a very interesting juncture.

MONEYMAN FUNDA CHECK

RANKING: B

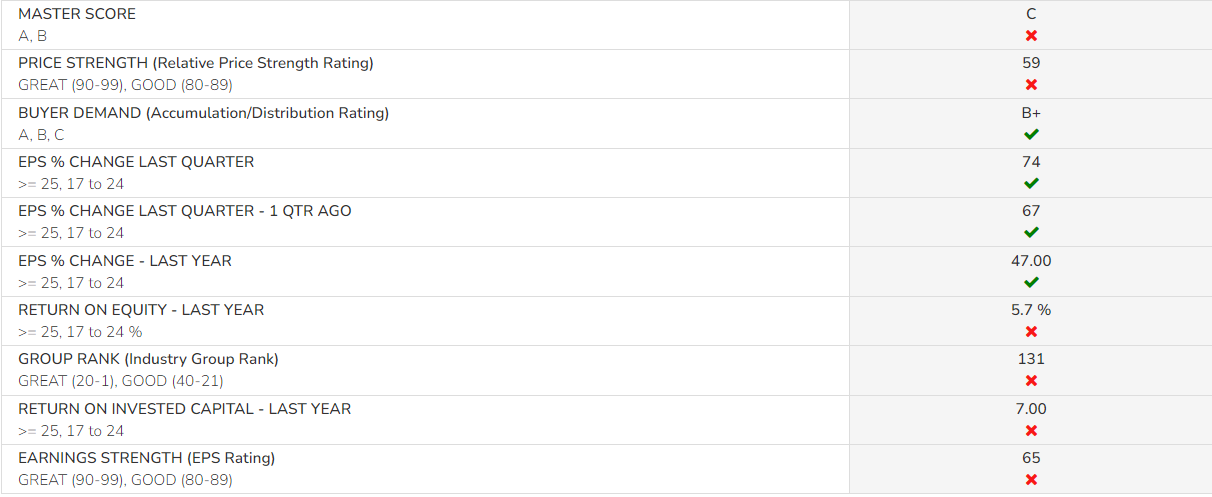

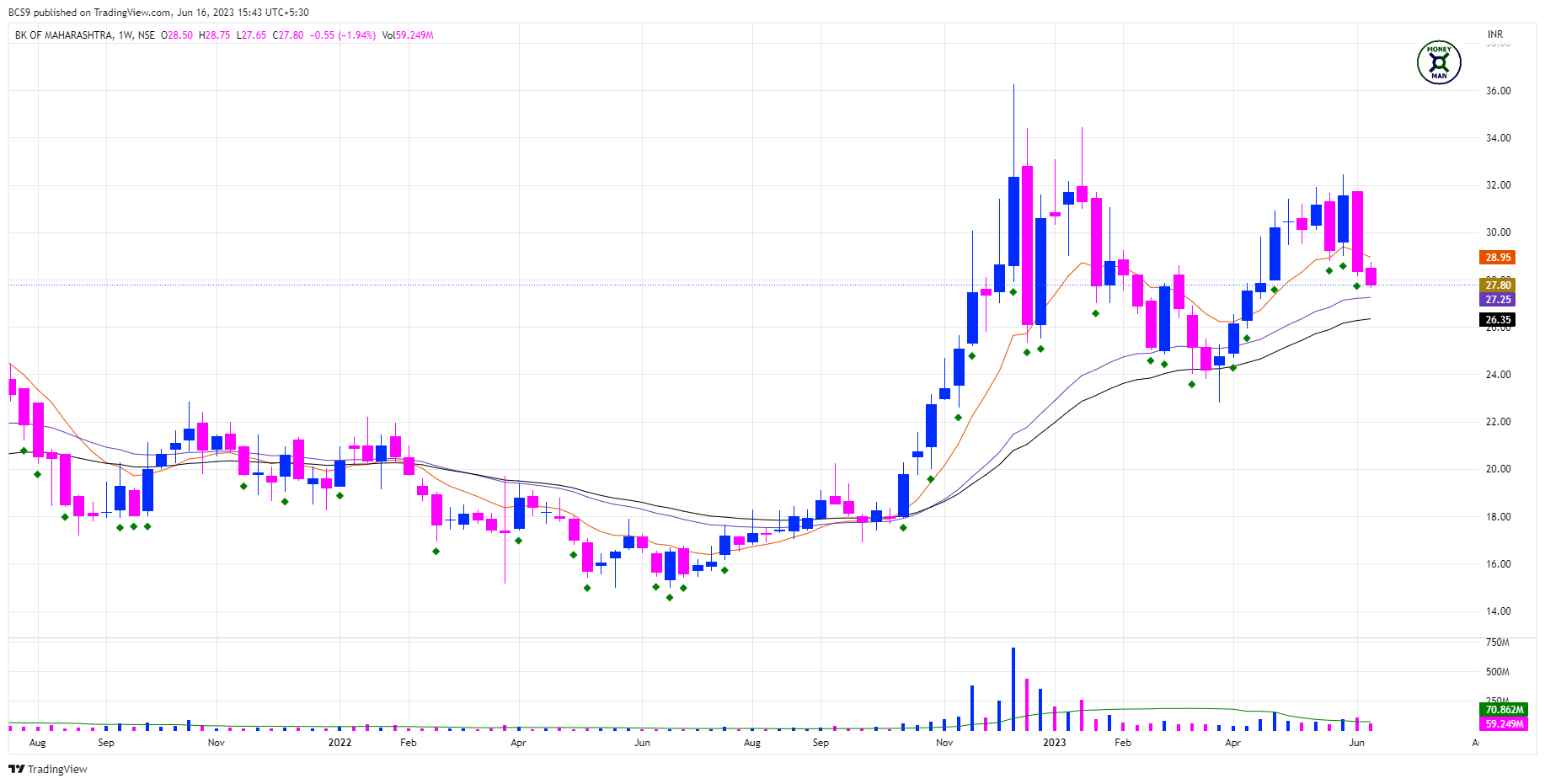

BANK OF MAHARASHTRA [#MAHABANK]

MONEYMAN TREND GUIDE

Breakout above Base / Trendline: NO

Good Buying Momentum: PARTLY YES

Good Volume Build-up: YES

Stage 2 Advancing Phase: NO

Price Action Structure: UNDER FORMATION

Institutional Footprint: YES

Strong Sector: YES

Good Relative Strength: YES

Minimal Overhead Supply / near ATH: NO

COMMENTARY

Will wait for it to react to sector moves and see if it can be a part of price leadership.

MONEYMAN FUNDA CHECK

RANKING: C

SUMMARY

The sector looks well set-up and a few stocks within the sector are also setting up well. The interesting thing to notice is that the ones which are setting up well are not necessarily the market leaders in terms of business share.

My bias is to always trust the set-up more than the business parameters because I firmly believe that price precedes everything else.

RANKINGS:

A: Good for deployment

BANK OF BARODA

B: Under watch

PUNJAB NATIONAL BANK, CANARA BANK, UNION BANK OF INDIA, UCO BANK, PUNJAB & SIND BANK,

C: Avoid

STATE BANK OF INDIA, INDIAN OVERSEAS BANK, INDIAN BANK, BANK OF INDIA, CENTRAL BANK OF INDIA, BANK OF MAHARASHTRA

Another effective, hassle-free, low cost and passive manner of taking part in the rally is to buy into the PSU Bank ETF. The most liquid as of now are PSUBNKBEES & KOTAKPSUBK

You can check some of my past Powerful Ideas which have performed extremely well in the markets here:

NOTE:

All financial / fundamental data has been generated using Market Smith India (with my custom parameters).

The 1st chart is on a monthly frame and the 2nd chart is on a weekly frame.

Moving Averages used:

Monthly frame - 10 Monthly EMA (Black).

Weekly frame - 10 Weekly EMA (Orange), 30 Weekly EMA (Purple) & 40 Weekly EMA (Black)

DISCLAIMER:

All information provided here is for educational purposes only and does not constitute any investment advice or recommendation. Please do your own due diligence. Products mentioned are not recommendations. The author has no incentive, financial or otherwise, to write about any particular Stock / AMC / ETF. All data taken is the latest to the best of the author’s knowledge.